Last Christmas, I blogged about always dreaming of buying my own place. I took the plunge this month. I didn’t wait for my CPF savings to accumulate to fully cover my home value as planned. In fact, I think I bought the home faster than I would typically buy a dress :-p.

What fascinates me most is the response I get from people around me. My home value is very near my cost of investment for Starhub. When I tell people I bought a share, they would typically remind me to diversify, they would tell me that the market is not looking good, the bear is going to come and that I am very courageous to put all eggs in a basket. However, when I tell people I bought a home, they would give me compliments without even asking me the home value nor location. AMAZING ! No wonder so many people found satisfaction investing in properties than stocks !

Anyway, buying a house is really a chore. There are so many procedures and paperwork that drives you crazy. There are so many hidden cost that you wouldn’t know until you sign the contract. There’s always a by the way, you need to pay this, pay that, blah blah blah…

Here’s my resale hdb buying guide for anyone who is interested :

Step 1 : Get your SingPass username and password ready

Step 2 : Check how much cpf you have – http://mycpf.cpf.gov.sg/Members/home.htm

Step 3 : Search for a Property via www.iproperty.com.sg or propertyguru.com.sg or srx.com.sg or H88.com.sg

Step 4 : Check the history valuation price of your desired unit – http://srx.com.sg

Step 5 : Check the lease period of your unit – http://services2.hdb.gov.sg/web/fi10/emap.html

Step 6 : Check whether the property is undergoing or has undergone uplifting -http://services2.hdb.gov.sg/webapp/BB33RESLSTATUS/BB33PReslStatusEnq.jsp

Step 7 : Get a witness ready as you need a witness when you exercise your option

Step 8 : Start viewing (Bring a friend)

Step 9 : During negotiation, take note of the Conservation Fee, Lease Period, Property Tax, Uplifting Fees if any

Step 10 : Sign Option To Purchase once you have agreed on the price (Maximum Option Fee is $1000)

Step 11 : Exercise the Option anytime within 21 calendar days (The Option Fee and Option Exercise Fee together must not exceed $5000)

Step 12 : Submit a Resale Application via HDB (www.hdb.gov.sg) – You need to pay an admin fee of $60.

Step 13 : Submit a Resale Checklist for Buyers who do not engage a Salesperson via HDB -http://www.hdb.gov.sg/fi10/fi10321p.nsf/w/BuyResaleFlatChecklists?OpenDocument#DIYBuyer

Step 14 : Submit a Valuation Request via HDB – You need to pay a valuation and admin fee of $191.90 – http://www.hdb.gov.sg/fi10/fi10321p.nsf/w/BuyResaleFlatValuation?OpenDocument

Step 15 : Your assigned valuer will contact you to arrange an appointment to view the unit

Step 16 : When the valuation report is ready, it will be available for download via HDB (www.hdb.gov.sg)

Step 17 : Set your first appointment with HDB – http://www.hdb.gov.sg/fi10/fi10321p.nsf/w/BuyResaleFlatAppt?OpenDocument

Step 18 : During your first appointment, you will need to pay the Conveyancing Fee ($5.35), Caveat Fee ($64.45), Title Search Fee ($10.40).

Step 19 : Inspect the unit one last time

Step 20 : In your 2nd completion appointment, the Registration Fee ($38.30), Stamp Fee ($7,140) and valuation price of your unit will be deducted from your CPF. You will also need to prepare the cashier’s order for remaining cash if your cpf is not sufficient to cover the above mentioned fees.

Step 21 : You may also need to buy insurance for your property (will update when I figure out the value :-p).

Step 22 : Keys Handover !!!

THE END, I HOPE ….

Anyway, since HDB requires occupancy for 5 years before I am allowed to dispose / rent out this unit, my plan is to stay in this unit for the next 5 years. Whether it’s happy days or renovation headaches ahead, I am not sure. Stay tuned ;-p

My Retirement Planning Project 2013 Series

My Retirement Planning Project 2013 - Property ?.

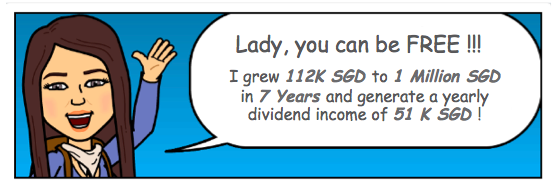

My Retirement Planning Project 2013 - SGD 51K per year passive income ?.

My Retirement Planning Project 2013 - Retire by 42 ?.

22 Steps … gosh…. Errr and is a shorter one without loan process ….

Hi Cory,

:). Painful. Forgot to add one step before Step 10 and another before Step 11 where you practically don’t sleep as you will be busy combing through the entire CPF and HDB website to double check on all the Terms & Conditions, If & Else. It feels like you are riding a roller coaster ride when signing that document. After you’ve signed it, you don’t really know what you’ve really gotten yourself into until you’ve gotten the keys!

Thanks for sharing these steps…….Really helpful.

Thanks Ron, glad you found it useful :).

Congratulations!! Buying a home, to me, is like falling in love. It comes when you are least expected. It happened to me twice when I wasn’t actively looking for one. : )

Hi Larry,

Thanks :-). Hope to be in love with it after renovation! I am in love with it’s location though 🙂

My love location is marine parade area near parkway but the HDB flats there very very expensive and also too old leow. Can I ask the location of your retirement home?

Hi Larry,

Marine Parade is a very nice place :). I prefer to keep my retirement home location private.

Lady, may i ask if you diy ur flat purchase?

I just came back from hdb resale seminar. Doesn’t seem too difficult. Esp i hv my finances sorted out. Don’t forsee a problem w a bank loan.

Hi Pf,

Yes. DIY. It’s quite simple, no need to get an agent. Follow through my guide and spend some time on HDB website. You should be fine. Have fun shopping ! 🙂

Thanks! I’ll do that. 🙂

this is very informative. thanks for taking time to pen this out.

Hi SL,

I’m glad it’s useful to you 🙂