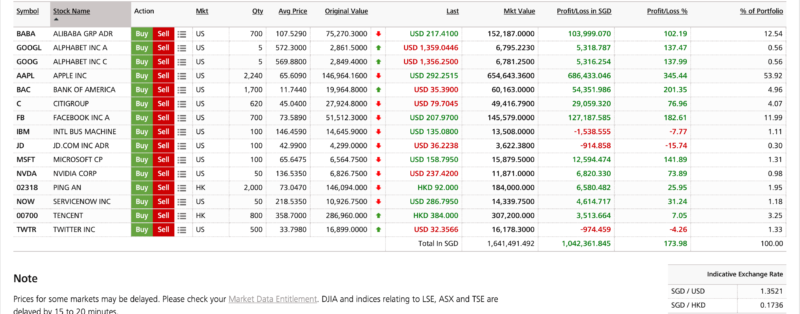

My Stock Report Card for Apr- Dec 2019

US Stocks

SG Stocks

Total Passive Income Collected Between Jan – Dec 2019 : SGD 45,819.68 ( 21,324.39 from SG Dividend, 6836.54 from USD Dividend, 4517.84 HKD, 14,467.38 from Structured Notes)

Total Profit / Loss from Sales of Stocks between Jan – Dec 2019 : -$812 (M1)

Stocks added between Apr – Dec 2019 : ServiceNow, Nvidia, Lendlease Reit, Ascendes Reit (Rights Allocation)

Merry Christmas !!! How’s everyone? Sorry to have been missing in action. Have been spending time on other priorities. I have started a new role and have been jet setting all over the world. Thus, I haven’t spent enough time monitoring the market. Luckily, on the 21st of December, my US portfolio passed the million dollar profit mark !!! I still miss the passive income I used to get from Starhub though.

What I have been listening lately :

https://www.youtube.com/watch?v=69m34vsjjsU

Hyukoh is releasing a new album in Jan and will have a concert in Singapore March 2020. 🙂

https://www.sistic.com.sg/events/hyukoh0320

Happy Holidays! I pray for a kinder and more peaceful world next year.

Congratulations!

Thanks John, wishing you and family happy new year!

Impressive! Congrats!

Thanks MunSeng, hope all is well and wishing you and family happy new year!

Congratulations, have been waiting for your update ! Wow ! Impressive!

Thanks Chengkk, sorry for not updating & wishing you and family happy new year!

Congratulations on sticking to APPL

Thanks Cory. Hope you are also reaping rewards from your investment. Wishing you and family, happy new year!

Hi, noticed you’re still using Vickers for your overseas portfolio. Wouldn’t it be cheaper in terms of commission, FX rate and the lack of dividend handling/custodian fees to use a platform like Interactive Brokers?

Hi Dom, Yes but I hardly trade my stocks. I usually hold long term and also the last I check, Vickers charges me a hefty migration fee.

I also feel more comfortable using Vickers as the chances of it going bust during times like financial crisis is less than interactive brokers considering now even the banks are offering massive discounts on transaction fees. Thus the survival of such independent brokers are being threatened.

Great Job!!!

Thanks MC, you have an interesting portfolio. Will be spending time studying your mix and hoping to learn from you!

Congrats! You have been an inspiration for female investors including myself. Just wondering if u would be doing anything to lock in profits, whether in part or all?

Hi KL,

Thank you so much for the kind words. To be honest. I might. Let’s see.

You are extraordinary retail investor in Singapore investment blogosphere who has shown fabulous investment outcome. Well done!

Oh CreateWealth8888, such kind words ! I have much to learn from you and really appreciate you keeping us updated on the process of getting money from CPF after retirement. Happy New Year !

Amazing dividend on your SG port that’s like 10% dividend based on your current port value.

I managed my year with only 8.6% total gain sg stock

Hi Jason, 8.6% sounds like a decent gain for sg stock considering the sg mkt didn’t move much this year.

Swee!

Thanks Peter Boo ! Hope you have a swee swee new year!

Congrats! That’s a remarkable achievement! Truly an inspiration for us all. Wish I can get there someday. 😄

Thanks ! Happy New Year the boy who procrastinates. What an interesting blog name!

Very impressed and inspired!

Congrats, It’s a great long term return that even the pros can’t beat.

Thanks Gerry for the kind words ! Pros definitely can beat, they have more instruments & cash to play with.

Lol that’s after alot of years..

I assume 6+7 years?

Not so impressive…

Hi Not Impressive,

Thankfully, the purpose of this blog is not to impress you :).

then what’s the purpose of this blog?

I think if u put in the index fund it will be higher returns than your current positions.

Moreover, it would be good to let your readers know ur return rate and when u started investing…….

Hi Happinessispointless,

The purpose of a blog is not to please everyone..to reiterate the purpose of my blog you may want to read this https://ladyyoucanbefree.com/about-me/. The contents may serve as an insight to one and not to the others. If index serves you well, please go ahead. Some people may tell you bitcoin serves them better, or property or trading etc. The winners are usually the ones who are curious enough to learn … Happy New Year !

Hi, when the guy has a good point. When did u start trading btw

HI Enthutrader,

I don’t trade.

Congrats! Will you consider buying Starhub now ? 😛

Hi Mike, Never :).

Hi I would really want to learn from you.

Btw are you still working ?

Hi Kelly,

Yes. Still working.

Happy new year, lady~

Been waiting for your updates haha

Nice additions of Nvda !

I was contemplating to buy Nvda but did not 🙁

Wish to have a overseas growth portfolio like yours someday!

Hi Frowns88,

It took me a long while before I took the plunge with Nvdia. Wish you success in growing your growth portfolio.

That is really impressive!! happy to hear that you seem to be enjoying work! I guess working when you know you are financially free to quit anytime gives a different perspective of life! hope to get there one day.

Thanks Mrs Spoon, Long time no talk ! Happy New Year ! How have you been ?

Hi Lady! been very busy with the family! with young kids and a day job, every day is hectic. career / job prospects is down as I am concentrating on my children, at least till they are older and hopefully, our bond is strong. noticed some not so nice comments on your blog! tsk tsk.. some people can be so jealous and discouraging. I love your blog so keep posting k. take care with this new virus going around. stocks are down but not so much.

Hi Mrsspoon, you are so sweet :). Wish you and your family a blissful new year.

Congrats Lady! Your investing journey is very inspiring for me as a new investor. Thanks for sharing!

Thanks Marcus, good luck in investing !

You are so impressive and admirable! I secretly look up to u. Will you be retiring any time soon?

I tried but it’s not easy to retire 🙂 when everyone else isn’t.

cool article! i will be sure to share this with the residents of Treasure At Tampines and JadeScape !

hihi, are you using a custodian account to buy foreign stock to grow your portfolio? Interested in learning investing.

Hi, no I am not.

Hi there, thanks for sharing your knowledge and experience in investing with us. I’m particularly interested to know your strategy between SG and US investments – do you keep a balance between SG and US and if so how? Do you see the higher capital gains from US equities as an injection into your SG passive income portfolio? I find myself sometimes debating between the growth and dividend investing styles as I see merits in both. Passive investing gives me a more peace of mind with consistent dividends, but as I’m currently mid-20s, I’m also aware that I can afford higher risk with the growth stocks. Appreciate your thoughts.

Hi Clare,

Happy to find a young lady who is keen on investing and is taking time to ask some clever questions. If you walk through my journey of investment through my blogs, you will notice that I started with the SG market, focusing only in building up my dividends. I moved to the US markets only in 2008 after I have build up a certain level of confidence in investing. Also, at that point in time, I started to feel that the SG market no longer seemed to trace the US market and the blue chips seemed to be in the process of getting disrupted. To answer your question 1) Do I keep a balance between SG & US. – No. I don’t do % allocations if that is what you mean. Take a look at the history of my portfolio. I used to be heavily weighted in SG stocks. Now, I am more into US as I find it harder and harder to find value in SG. 2) Do you see higher capital gains from US equities as an injection into your SG passive income portfolio ? – I am not sure I really understand this question. I don’t intend to inject the capital gains into my SG passive income portfolio. Many of the US stocks that I buy I intend to keep for a very long time. Finally with regards to whether a mid-20s should take more risk in growth vs dividends. It depends on your risk profile actually. I know of many young men who were so aggressive in their 20s when it comes to investing that they end up losing so much money that they decided to exit from the market completely aka BURNT. At the end of the day, growth or dividend, it doesn’t really matter. The key is to make sure you can answer these questions with confidence and can sleep well at night 1) Do you know why you are buying the stock 2) Are the fundamentals sound 3) Are the price level good 4) How long are you going to hold the stock 5) When do you plan to exit. Hope this helps.

Waiting for an update or post! Thanks for inspiring!

Hi Dlee,

Roger :).

Hi Lady,

It might be good to continue working. The earned income can be used to channel into the investment portfolio which will generate more dividend to cover the expense.

WTK

Hi WTK,

Hope you are safe, healthy and happy ! To work or not to work?! If work, how to find a work that fulfils you and don’t eat you up. That is the most challenging question for everyone in their 40s.. I guess…

Hello, may i know your stock report card table interface is from which trading platform? Its v clear!

Hi Krissie, It’s DBS Vickers.

Hope go read your update soon.

Hi Jacky,

Roger ! :).