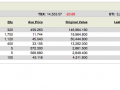

My Stock Report Card for April 2014

Total Dividend Collected from Jan – Apr 2014 : SGD $14,735.66

Sold ST Engineering. Bought Twitter and Google just for the fun and thrill of it. :-).

I also took the plunge to buy myself a retirement home (resale flat). I have decided not to take any loans, thus I will be using my cpf to fully pay for this flat and fund the rest via cash. In the coming months, bulk of my income would be diverted to pay for renovation. I guess I have to revise my passive income goal this year to SGD 60K instead of SGD 65K. Exciting year ahead :-p

Good afternoon lady, 2 qn.

1. Do your P/L includes Dividends ?

2. Any plan to re-balance your portfolio considering your portfolio is heavily concentrated on one stock.

Hi Cory,

1) My P/L does not include Dividends. Dividends is shared separately in the article itself.

2) Diversification is part of the plan. You may want to read this link for more information on how I plan to diversify.

https://ladyyoucanbefree.com/2014/01/18/2014-passive-income-playbook-diversification/

Hi there,

You are so cash rich! Anyway, do you intend to rent out your flat? If so, the rental can be a form of passive income as well. Somemore the yield should be better than the saving or FD rate. Smart move!

Regards,

SG Wealth Builder

http://www.sgwealthbuilder.com

Hi Gerald,

I am not cash rich, I am cash strapped. When you reach my age, you would have accumulated enough CPF to pay for the unit. :). 5 years later, I will need to decide whether to rent it out or stay put. Will let you know then.

Great job. I feel you are in the right direction. Congratulation on your new resale flat.

Hi Cory,

Thanks for the encouragement. I also hope I am moving towards the right direction. Keep fingers crossed.

Hi Lady you can be Free!

Chanced upon your blog and am impressed and inspired by the financial progress you have made over the last years. Was the report card churned out by your broker (DBS Vickers?). Do you do margin and derivative trading? You are a high-income earner – care to share which industry you are from?

Hi Inspired,

Glad you enjoyed my blog. Yes, the report card is via DBS Vickers. Margin and Derivative trading is greek to me and which industry I come from is not important :).

Congrats lady on ur purchase of new home 🙂

Thank you Dan :).

It’s amazing how you grew your portfolio almost 10x in 7 years! Now I’ve a role model I can aim to be. 🙂

I’m currently in my mid-20s, and aim to invest in growth stocks and blue chips. Hope to grow my capital asap before moving on to build a dividend yielding portfolio.

Any thoughts on restructuring your portfolio in view of rising interest rates?

Hi James,

Glad that I can serve as some form of inspiration. Think growing the capital first before moving on to build a dividend yielding portfolio is a sound move. No intention to restructure my portfolio in view of rising interest rates. This topic has been in the market since december last year. In fact, I may take the chance to pick up more stocks when prices are depressed due to rising interest rates, if I have spare cash.

I am a single lady, I hope I can be like you one day ! I am inspired by your blog!!!

Hi 一只小鱼, 加油!