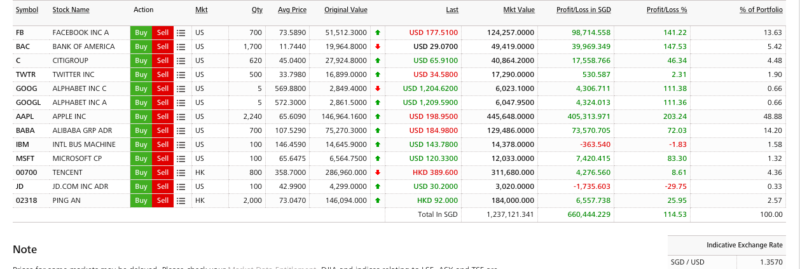

My Stock Report Card for Jan – Mar 2019

US Stocks

SG Stocks

Total Passive Income Collected Between Jan – Mar 2019 : SGD 19,392 ( 4,924 from Dividend, 14,467.38 from Structured Notes)

Total Profit / Loss from Sales of Stocks between Jan – Mar 2019 : -$812 (M1)

Stocks added between Jan – Mar 2019 : None

It has been a rollercoaster 4 months. We are back at the all time high range. I am again in this to sell or not to sell mode. Lucky for me, the structured note that I bought last year managed to expire this month without any glitches (A very close shave!!). This structured note experience taught me not to blindly follow yield. The cash that I used for this structured note were meant to pick up bargains during the bear market. Instead, I almost had to pick up equities at a relatively high price due to the structured note equities basket and totally missed picking up bargains during December. Alot of my friends were caught up in the hyflux incident, which once again reminds us to diversify and not let yield cloud judgement.

How was your first quarter ?

Interesting portfolio. I got a better bank choice. OZK take a look.

Hi Khai Teoh,

Never heard of OZK, will take a look. Cheers

I’m opposite. I keep selling taking small profit gotta learn how to hold better.

Q3 sounds dangerous what do you think ladyy.

Hi Jason, It hasn’t felt safe since last year :). Taking profit is good ! I need to learn from you. Staring at paper gains is no fun and may end up with a stupid outcome 🙂

I think unless there’s some major fundamental change in a company or an asset, we shouldn’t do major selling (or buying).

For those who want to have more active hands-on mgmt, some plausible reasons to increase buying or selling would be things like re-balancing, overbought or oversold indicators etc. And usually will involve some or incremental buying / selling, not wholesale going in or total cut of a stock or position.

For those still in accumulating phase with a long timeline ahead, don’t really need to bother except for any major fundamental issues or once a year re-balancing.

Hi Sinkie,

Agree with you. But sometimes, the heart, the common sense and theory can’t stop talking to each other 🙂

Hi Lady,

My approach is to invest for the passive income. The passive income from the investment cover my expenses. It gives me the peace of mind and I can focus on my interest without worry.

My two cents worth of opinions.

WTK

Hi WTK,

Thanks for sharing 🙂

Hi Lady,

I wonder which platform do you use to trade in US stock?

Hi Kiki, I use DBS Vickers to trade US Stock. However, if you are trading actively, you might want to explore some US brokers e.g. interactive broker, thinkorswim etc.

Hi,

May I know which platform do you use to trade in US market?

Thanks 🙂

Thanks for being so inspiring. I came from a poor family background, single lady as well. Learning to build my portfolio which currently consists of mainly Reits generating dividends for me. Do blog regularly, I will read them all. Thank you.

Hi Neo,

Thanks for the kind note. Will try my best to blog more regularly.

Thanks for being so inspiring. I came from a poor family background and a single lady. I’m learning to build my own portfolio. Currently, it mainly consists of Reits to generate dividend for me. Do blog regularly, I will read them all.

Hi Lady,

I have a quesiton on ADR fees as you know Alibaba is going for a 1-8 split so in theory if let say every year i pay $5 fees now i have to 5×8=$40 for the fees am i right what is your view? do you pay fees for other stocks as well?

Hi Ninja,

I am also very confused with the ADR fees. For BABA shares, I am currently paying 0.02/SH i.e. $14 USD. I guess when it split to 8, you will need to pay 0.02/SH x8. You may want to check with your broker. Cheers

Hi Lady, was wondering what your opinion was on holding cash in this environment. Excluding emergency funds, what percentage is reasonable? I’m about 10 percent in cash right now and am wondering if these funds are better deployed if my investment horizon is 20+ years.

Hi Dividend Collector,

In view that the market has gone up so much, definitely good to keep some cash to pick up bargains in the next dip. Cheers

Hi, haven’t seen you post for a while? What is your current strategy for the market?

Hi,

I am nibbling some bargains.