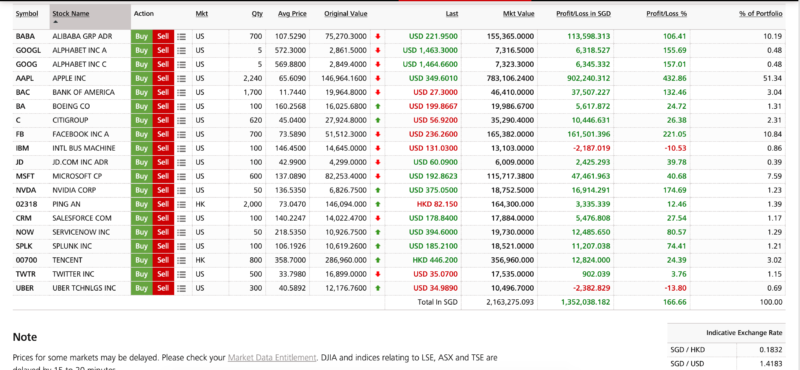

My Stock Report Card for Jan- May 2020

US Stocks

SG Stocks

Total Passive Income Collected Between Jan – May 2020 : SGD 11,307.02

Total Profit / Loss from Sales of Stocks between Jan – May 2020 : SGD 0

Stocks added between Jan – May 2020 : Boeing, Microsoft, Salesforce, Splunk, Uber, DBS, OCBC, AimsAmp Reit

Hello ! Happy graduation from Circuit Breaker. NASDAQ hit 10,000 for the 1st time ever today. I thought this may be a good time for me to do a mini update. I wanted to do one during March when the market was falling but it recovered so fast that I didn’t even have time to finish up my shopping. I hope everyone had a chance to catch some bargains and is now enjoying the fruits. This insane euphoria in a pandemic environment.

Some updates on what I’ve been doing lately while working from home. I’ve been taking time updating my CV and getting some certifications. Thought I should share some good tools here since everyone is probably feeling abit edgy on the job security front.

Improve your Resume

Check out these links to improve your CV. Apparently, companies nowadays use AI machines to scan through our CVs to pick up candidates that best match the job description. Thus, these sites allows you to first scan your CV to determine how good they are and provide suggestions for improvement. They also allow you to paste the job description to do a match with your CV to let you know what are the missing keywords you need to add to your resume to improve your chance of matching.

Improve your Credentials and Maybe your Investments 🙂

I’ve just gotten myself certified for Azure Fundamentals, AWS Certified Cloud Practitioner and Scrum Fundamentals. These are all FREE trainings and the certification only cost around 100-150 USD. I’m not sure why skills future only allow us to claim for expensive training programs which typically cost 4-5 digits and not these certification exams. (SHOUTOUT to the skills future folks if you are reading this !)

- https://docs.microsoft.com/en-gb/learn/

- https://www.aws.training

- https://www.scrumstudy.com

- https://www.coursera.org/learn/machine-learning

- https://www.coursera.org/learn/aws-machine-learning

- https://www.tableau.com/learn/training/elearning

Many people asked me how do I pick my investments. Well, sometimes it helps when you spend time learning and understanding the technology and roadmaps behind the companies you invest in besides their fundamentals. Ok, I admit that I missed out on Amazon and sold off Tesla too early :-). Ouch !

BTW, if you have good learning/training lobangs to share, please leave a comment below.

What I have been listening lately :

Remember to give thanks to the one who has been cooking and cleaning after you during this challenging period. It must be a nightmare for them having you at home 24 x 7 ;-p.

I pray for a kinder, healthier and more empathetic world by November. Stay safe, healthy and happy everyone !

Hello there!

Congratulations on passing a million dollars in profit! Will like to know, what do you think of ETF and UT investment instead of stock picking and would it have given you less stress if you looked back retrospectively? Thanks and look fwd to your second million!

Hi Yi Hao,

Thanks for reaching out. I’m ok with ETF as it traces the index. I am not so much into UT. Reason, UT is basically passing your money to a bunch of funds managers. Unless you religiously follows these rockstar fund managers and their whereabouts and trackrecord (which we retail customers typically don’t have the deep insights to the individuals except from the fund brochures), there is an additional risk and commission that you are leaving on the table. I actually do enjoy the process of shortlisting my own investment. Maybe when I am older where my brain may be more foggy. I may take the ETF route. Who knows. Hope this helps.

I discourage investing in UT. Basically, you are allowing people who play with your money.

Rather lose it yourself and learn some lessons.

Hi Kai,

Well said :).

Thanks! I did lose some money for the painful lesson. hahaah…not cheap but valuable

Splunk is a good pick. Take a look at Atlassian (DevOps Tool Provider) too!

As a software engineer, I am really looking forward to invest in the new list of pre-ipo tech companies in the near future. Like Stripe (Payment Giant in the wild), HashiCorp (IaC Pioneer), Databrick, and more.

Ah…I didn’t realised Stripe was planning to get IPO. No wonder my twitter is not moving. Jack must be too preoccupied.

Will check out the recommended list. Databrick has been all over my fb, need to check it out. Thanks 🙂

Amendment : Opps, I realised I mixed up Stripe with Square :).

Hi, which platform do you use to buy US market stocks?

Hi Jason,

I am using DBS Vickers.

Hi, thanks for sharing:) Congrats! You are my example to achieve financial independence!

Hi Daren, Thanks for the kind comments. Wish you success in achieving your financial independence.

Very impressive! Congrats to your achievement in investment!

Thanks Lynn.

Hi LYCBF, this journey of yours is awe-inspiring! I wonder if you will be inclined to start some form of mentorship or discussions to share your ideas? I’m sure there will be loads of people willing to pay a fee to attend.

All the best.

P.s. love your insights in the tech fields.

Hi Robin, thanks for the kind comments. I don’t think I am professional enough to start any form of mentorship or discussion. There are plenty of such resources on the Internet already. I think the key is to be able to digest them and form your own conviction. Good luck in your investment journey !

Do you use DCA strategy to shop for your stocks or you buy a bunch of them at a given time? If it’s the latter, could you share more insight to the variables you take into account when making purchases?

Hi Ken,

No. I don’t do DCA. Variables that I take into consideration typically includes price history, financials, roadmap, risk management, “market survey” and occasionally technicals.

Hi, thanks for sharing your portfolio! I would like to say you are a great inspiration to new investors like me. I personally prefer dividend stocks in my portfolio (Especially REITs) but your earnings on US growth stocks is starting to make me rethink. What would you recommend as the appropriate balance between growth and dividend stocks?

P.S. Your portfolio is truly inspiring

Hi Dividendisking,

Thanks for the kind words. I don’t really follow a formula in term of % allocation between growth and dividend stocks. My journey is documented sequentially in my blog, if you walk through the journey, you will notice that my concentration in early days are in SG stocks and dividend vested, I decided to diversify after noticing that there are disruption happening in the SG markets esp. dividend driven stocks. Thus, now you may notice a higher percentage allocation in growth. Usually it’s based on my confidence level on the equity and sector I am investing in. Hope this clarifies.

Hi Lady,

I thoroughly enjoy reading your blog. It is inspirational and educational.

In 2016, you challenged yourself to try out trading based on technicals. Your initial conclusion then was that while you made some profit, it wasn’t a sustainable journey for you.

I am focused on fundamentals and investing for the long term and have always been somewhat skeptical of trading based on technicals.

May i know what are your thoughts on technical analysis now as a tool to grow wealth?

thank you!

Hi Emika,

Thanks, it’s always good to hear that the blog is useful in providing insights. I believe investing (long term) and trading (short term) are two different activities that can be performed in the market. When you trade, technicals are extremely useful as you are focusing on trends, patterns and market sentiments. Thus, the technicals provides you with those insights to determine how you want to execute your trade. When you invest, you will probably focus more on the fundamentals but technicals can be useful when you are trying to determine a good entry or selling price e.g. Fibonacci, pivot points etc. Example, I know of trainers out there that uses fibonacci to determine when to buy or sell their investment i.e. when Fibonacci level reaches above 70%, sell; below 30%, buy. Hope this helps.

Thank you for taking time out to reply!

Does this mean currently you also actively deploy technicals as a tool for your own entry and exit prices?

Hi Emika,

No worries. Let’s learn from each other.

I use it occasionally when I am buying, I sucked at selling ;-).

Hi Lady,

How did you even find the determination to hold on to your profits and let them run?

For me, I will get spooked if my profitable stocks drop 20% and I will just sell them away. Your Apple stock is one good example.

Hi Cedric,

I think by spending time understanding the business of the stock I am holding on to and why it dropped or rise allows me to have the conviction to follow them through.That said, you will see I have some rotten apples in my Singapore portfolio. I am still learning the art of selling.

Hi Lady,

I am impressed on your US stock holdings. Do you trade US stock when you first started? I saw you are basically holding on to your US stock which are already 1 or 2 bagger. You have no intention to cash out your US stock holdings as most of them actually do not give dividend. You must have the conviction to keep on holding to it. May I also ask how long have you invested in US market?

Hi Eric,

Thanks for the kind words. I started to invest in the US market in 2008, my first stock was apple and I added more through the years. If you want more insights, feel free to browse through my old blogs as they were arranged to trace my investment journey.

2 mil sgd stock portfolio! Why are you updating your resume again ..??

Hi cc, this is the first time I shared that I was updating my resume. Did you mistake me for someone else?

“Again” ..as in “Soo.. explain to me again, why exactly do you need a job?”… I mean “again” as a colloquial way of expressing shock that someone in your position is worrying about jobs/resumes.

Hi cc,

I realised I get and make better investment ideas and decisions when I am working. Also, I enjoy connecting with people.

What are your views on Roboadvisors? Your portfolio is very impressive. May I ask how many years did you take to hit 2M dollars on your US portfolio? Thanks also for sharing the certifications.

Hi Manick,

My problem with Roboadvisors

1) Algorithms – There is no way for me to fully understand the algorithms that drives the decision making in terms of portfolio rebalancing. Esp. how it would behave in an erratic market conditions.

2) Startups – In 2008, with the financial crisis, you see banks going bankrupt. Roboadvisors are typically ran by startups with little transparency into their financials, audits and rely heavily on VC fundings to keep them alive. This adds another element of risk to my investment portfolio. I wouldn’t be putting millions of dollars into them.

As for how long I took to hit 2M dollars, you may want to check out my old blogs to trace the journey. Hope this helps! Good luck in your certifications :).

Hi Lady,

I have a dilemma. I bought stocks during the March low and now i sitting on a healthy paper profit. I am kind of a long term investor, willingly to hold funds for at least 10 years. So my question is, should I go into the market and avg up on my profitable stocks or its better to wait on the sideline for now?

Hi John,

Congrats on the healthy paper profit. I am not sure which market and stocks you are investing so it’s difficult for me to give you proper advise. Also, I am not a professional, so you should take my advise with a pinch of salt. Typically, the investing bible will tell you to do a rebalancing of your portfolio in terms of % allocation and maybe take some profits. I wouldn’t be averaging up considering US & China markets are currently trading at a all time euphoria level. It’s either take some profits or wait for the dip. Hope this helps.

Hi, I bought Microsoft, Google, Disney, Visa and Vanguard VOO etf.

Thanks for the advice, I guess SG market would be a better market to go in now as we not at Euphoria level yet?

Hi John,

Good choice for the US bit, am struggling with Disney though and Google seemed a little lost with their long term vision lately. Not sure if SG market is still a good buy esp. after the election :).

why especially after the election? Maybe this should be a private conversation given how intense debate have been online this elections!

Yah.. I don’t want to be cancelled :). I want to keep this blog until I am very old, so that I have something to occupy my brain and time :).

Hi Lady,

I missed the Mar low and now staying on the sideline waiting for opportunities. What would you do with the capital on hand if you were me? Will you continue to wait or start picking up some stocks? I’m an investor looking at the long term and want to have both growth and dividends stocks like yours (US, SG/HK).

Just want to know your thoughts since you have been investing for a long time.

Hi Adrian,

I would just wait on the sideline if I were you and build up a watchlist with a target entry price. Whenever there are opportunities, I would pick them up little by little.

Hi Lady, you can be free! It’s Mrs Spoon. I bought some during the Jan- Mar but I bought too early and got nervous towards end of March, so my shares doesn’t look as good. but I’ve learned to be grateful so at least I scooped a little. got some duds too, and sold a good US share too early so a little sad. but yes, grateful grateful grateful. I hope I reach a nirvana level like you about work. Work to me is still just a means to feed myself. my kids are growing too fast, and I doubt I will ever be able to be there for them fully but WFH is doing my family good.

Hi Mrs Spoon,

Congratulations on making a scoop :). I’m not sure whether I have reached a nirvana level about work. I am trying to but work is always a complicated animal to me, not the job itself but the politics and people. It’s an art. I always respect woman who can work, clean, have kids. I can’t even cope taking care of myself. And Mrs Spoon, you even invest ! RESPECT :). JIAYOU !!!

It’s been easier (and more difficult) with WFH. I dunno if I will feel more relieved at work once there is no longer a financial burden? thank you for your kind words anyway! keep safe during this period!

hey lady, im new to this industry, i have done a little on forex before, but im still very much lost as to how these things work. Can i know if there is a maintenance fee for keeping the position of your stocks if you do not close the trade? because i face this on forex and i would like to know if stocks works the same way…. thanks… 1 more thing, may i know what platform do you used for SGD stocks?

Hi Wonrei,

If you trade via CFD platforms then you will be charged a maintenance fee. Else, buying stocks only incurs transaction fees when you sell/buy. I use DBS Vickers for SGD stocks.

BTW, if you use some of the US brokerage firms like TD Ameritrade, Interactive Brokers etc. They offer much better rates than DBS Vickers. The reason I stuck to DBS Vickers is only coz (1) I started with it and is too lazy to migrate, (2) for convenience and (3) security (i.e. in case the brokerage firms goes default). They don’t actually have the best rates in the market.

ahhh ic…. may i know wad websites u used n wad books u can recommend?

Hi Wonrei,

I’ve wrote a quick guide some time ago that may be useful for you. https://ladyyoucanbefree.com/getting-started-with-investment/. I may do an update on this soon. Hope it helps.

Hi Lady, I’m on Vickers as well. Apart from trading fees, there is also a custodian fee for stocks if the transactions fell below 6 per quarter.

Hi Kai,

Good point. Sorry, I may have missed that out.

Pingback: Reflecting on July 2020 - My Sweet Retirement

Congrats

Hi WarriorTan, Thanks :-).

may i know how long u took to get to where u r today? like how long u took to have a full understanding of stocks, how to trade properly. Was it really tough?

Hi wonrei,

I started in 2005. My site is designed as a timeline thus you can actually trace through my whole investment journey https://ladyyoucanbefree.com/page/5/. I enjoy the process very much and am constantly learning, even today.

can i know roughly wad to look out for in a company’s financial report before purchasing stocks?

Hi Wonrei,

Basically, you need to assess whether the business is healthy by looking at the financial statements. Any financial statement training or books that teaches you how to assess a business would be relevant. Here’s an example :

https://www.youtube.com/watch?v=FOi2CHktfvQ&fbclid=IwAR2JEG77mU5n2cN6fUqSktCQEBybKRLr_X3wNUWyPJE5VnZPsYz1WjUphgc

Is it too late to enter the US market? any thoughts?

Hi XXXXX,

There are still bargains in some sectors but some sectors are way overvalued e.g. Tech

Cheers

do you think there will be another global financial crisis? In the event of global financial crisis, will you liquidate all your stocks? Haha

Damn sad, cause i reacted too slow. Never sell away my stocks in feb/march 2020.

Hi Xxxxx,

Usually I will be buying during a crisis instead of selling. I call it the great sale. There will always be many crisis in our lifetime.

Congrats Lady, you can retire already with Apple hitting the 2 trillion market cap.

Even my microsoft and google cannot perform so well :(.

Hi John,

Let’s cheer for Microsoft and google to be the next 2 trillion market cap ;).

Lets see what happens after the Jedi contract. 🙂

:). Eh…what is the Jedi contract ?

Its the Joint Enterprise Defense Infrastructure given by the US Department of Defense and its worth 10 billion dollars. Microsoft actually got it but Amazon wasn’t happy about it and they sue to stop and force DoD to reevaluate the contract.

In 30 days, we will know the result.

Ah ic. I read about it but wasn’t following it too closely. Hmm.. are you working in Amazon or Microsoft 😉

Me? I wish i was working for Microsoft and Amazon. That said, I have friends in Microsoft though :p. Sometimes i do ask them for minor insider stuff.

Hi John,

I heard it’s better to own Amazon than to work for them ;-p

Pingback: Reflecting on August 2020 - My Sweet Retirement