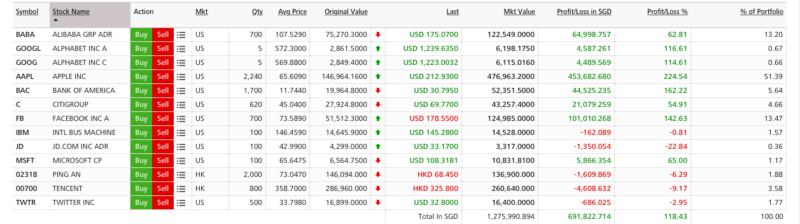

My Stock Report Card for Jan – Jul 2018

US Stocks

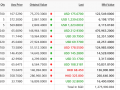

SG Stocks

Total Dividend Collected between Jan – Jul 2018 : SGD $ 16,068

Income distribution in Jun and Jul came from Frasers Hospitality, Aimsamp Cap Reit, UOB, Mapletree Industrial Trust, Mapletree Logistic Trust, OCBC, NikkoAM STC Asia Reit, PingAn Insurance, Bank of America, Tencent, Intel, IBM, Microsoft.

Total Profit/Loss from Sales of Stock between Jan – Jul 2018: SGD 6690.18 ( Structured Note Knock Out, Intel, Tesla btw Jun – Jul ).

Is everyone enjoying the roller coaster ride in the markets ? I’m not :-p. Every stock that I owned seemed to be a headliner lately – Tesla, Intel, Apple, Facebook, Twitter and Tencent ! Even Keppel is suffering a double whammy from the latest property curb and the ever so volatile oil prices. Thanks to Grandpa Warren Buffett, my US portfolio managed to still grow despite all the negative headlines ! I took the chance to add more Frasers Hospitality, Tencent and PingAn during the market dip. I decided to let Tesla and Intel go because although I love Elon for his vision, he’s getting alittle out of hand with Twitter. As for Intel, I am a little spooked by the china micron ban, lack of leadership (no CEO) and competition from AMD.

I pray for a more peaceful Q3/Q4.

This is what is keeping me sane lately …

https://www.youtube.com/watch?v=7LEmer7wwHI

do your best.you are an inspiration

Thanks Kyith ! 🙂

Mrs Spoon here again. you are such an inspiration!!! i hope my portfoilio will look as nice as yours one day.

Hey Mrs Spoon, Where can I see your portfolio?! You can do it!

Wow how long did it took for u to build up a portfolio like this?

Hi Andy,

I started my investing journey in 2005. In fact my blog is designed as a timeline. If you are keen, feel free to scroll to the beginning to trace my journey.

Relax, no worries

Hi Ok,

Ok 🙂

Hi Lady

Mind to share the app you use to track your portfolio record?

Want to start doing like what you do 🙂

Hi Sun, I am using my broker’s online app – DBS.

I have a question! U bought quite a number of US Stocks. Is there any additional charges or tax to be paid when u purchase an US stock? What about dividend? If there is any additional charges, dividend would have been cut by a lot.

Hi Kazun,

There is a 30% tax on dividend. There are no capital gain tax if you sign and submit a W-8BEN form to declare that you are not a US citizen. Your broker will be able to advise you on this. My strategy has been US mkt for growth, SG mkt for dividends. But if the US stocks gives me dividend as well, I will gladly take it.

Hi there, i actually did some analysis on DBS and thought it is actually a really good deal now. Would you care to critique?

https://singaporestockpicker.wordpress.com/2018/11/20/dbs-d05-shares-a-good-deal-now/

Thank you very much!

Hi SingaporeStockPicker,

Thanks for sharing. I don’t think I am qualified to critiqued. All I can remember is that in 2008 during the financial crisis, DBS was at $7 bucks. If someone had the courage then to pick it up, they are a very rich man/woman today. 😉

Hi. Just a genuine question here and no offence. How come even though your capital is much larger but your dividends arent as much as some bloggers that you are following?

Is it purely because they invest in only Reits and you have others?

What about the pros and cons of their way or your way.

thank you.

Hi Bz,

I am using my SG stocks to build passive income and US for capital appreciation i.e. growth. If you’ve looked at the history of my SG stocks portfolio, it has shrunk quite significantly as I recently sold away starhub which has been a star passive income generator for me previously. I am now keeping more cash to wait to rebuild my passive income. As for pros and cons of whose way is better, I don’t know. All I know is I sleep quite well with my current portfolio, thus it works for me. What works for me may not work for other people as different people have different risk threshold and investment experience. Hope this helps.