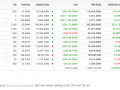

My Stock Report Card for Jan – Dec 2017

US Stock

SG Stock

Total Dividend Collected between Jan – Dec 2017 : SGD $ 27,296.13.

Total Profit/Loss from Sales of Stock between Jan – Dec 2017 : SGD 120,423.21

This quarter, I added some Tencent, Intel and Alibaba during the minor market dip. Sold off the remaining Starhub shares (Profit : $20,032.63) when the CEO resigned.

What a year 2017 ! Crazy paper gains from my US portfolio. Expected disappointing dividend returns due to the sales of Starhub for my SG portfolio. Looks like I have to review and relook into my passive income investment strategy. I will probably keep more cash now and wait for a better market timing to rebuild my passive income. Thus, 2018’s dividend income would probably be a disaster.

A shoutout to feedspot for nominating my blog as “Top 100 Singapore Blogs and Websites for Singaporeans”. To be honest, I have been lazy in my blogging in the past year. However, whenever I thought of quitting, I will get a gentle private nudge from readers to check whether I am still alive ;-). That actually moved and motivated me to continue. Thank you to all who have reached out !

Sharing a beautiful song that has been looping non-stop in my playlist during the new year. Happy Wow Wow Year to all ! 😉

https://www.youtube.com/watch?v=VWUXzFWO8Rc&feature=youtu.be

US financials would probably continue to do well with the new US tax code & rising interest rates.

China tech companies are in secular bull thanks to the growing consumerism & middle class growth of China. 🙂

O&G and related M&O may make strong comebacks as this bull ages & inflation returns.

Hi Sinkie,

I hope so too. Let’s pray that the two boys will stop fighting about whose button is bigger. Fingers crossed.

Hi.

Congrats on your portfolio performance!

Can i check how old are you now, how long have you vested, and what is your accumulated capital? Thanks.

Hi investto, here’s some clues for you https://ladyyoucanbefree.com/about-me/. Cheers!

Wow!! Congratulations in your massive returns from US stocks! Very respectable returns you’ve got there for 2017!

Hi sleepydevil,

Don’t congratulate me until I sell them 🙂

Congratulation for the top 100 Singapore Blog award.

Thanks sanye. Are you the sanye with the awesome portfolio with crazy returns?

To be honest, I was expecting more dividends from your portfolio. I guess a big reason is most of the tech stocks do not pay out dividends.

Interesting that your US Portfolio is now way bigger than the SG one.

Any thoughts of rebalancing towards the SG one? Or that’s likely where the cash will be poured into for 2018?

Hope you had a good start to the year!

Hi 15HWWW,

Yupz and there’s a 30% tax on dividends from US. My strategy has always been Singapore for dividends, US for capital gains. To be honest, I am struggling to find anything attractive in the SG market that I am keen to pick up. I will probably stay out of the market in 2018 and selectively pick up bargains, if there’s any. Think 2018 is harvesting time for me, not so much planting.

Hi!

May I know which app or website you’re using above to track your SG and US stocks?

Thanks!

Hi SajNT,

It’s not an app. It’s my broker’s website.

Hi, what do you use to buy US stocks?

how much are your charges?

Hi Irene,

If you are looking at trading US actively, you might want to explore interactive broker or TD Ameritrade.

Their commissions are much lower. I use a local bank broker, typically commission cost is at $25 or 0.3% of trading principal. Reason is I don’t trade actively and I started with the broker and is too lazy to migrate to another platform. The migration cost is quite significant as well. Also, I like the assurance of a local established bank broker as the chances of them going default is slightly lower.

Congrats! Your returns and the amount of money you investing are still very impressive. Ya every time I see my US dividend being taxed 30% it’s not a great feeling

Hi diyquant,

Thanks !

Hi! I am so impressed. Would you use another platform for your uS shares if you could start again? I was looking at the stand chart platform recently. As you know, I am also female in my late 30s so I am really inspired by you. Do you still work or already achieving part time freedom?

Hi Mrs spoon,

Thanks ! You are always there cheering for me. If I were to start again, I probably will still use the current platform as if a bank can go bankrupt during the financial crisis. I couldn’t imagine having stocks sitting in smaller 3rd party brokerage firms during those times. I am sure you can do as well if you start taking action. Good luck :).

Amazing insights and your portfolio performance is no small feat. No wonder this has been nominated the top 100 blogs. Love how you keep things clean and I am so far away from emulating your results. Just hope to share how I compliment trading with dropshipping as it doesnt require constant watching and is effectively a hands free business. Get to know more about it here https://tinyurl.com/passivedropship

Hi yan guoy,

Thanks for sharing. Will check it out.