My Stock Report Card for Aug – Nov 2016

Total Dividend Collected from Jan – Nov 2016 : SGD $ 59,048.62

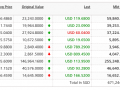

Income distribution in Aug to Nov came from M1, SMRT, Keppel Corp, Singtel, OCBC, Suntec Reit, Keppel Reit, Starhub, Capitamall Trust, Sabana Reit, HPH Trust, Aimsamp Cap Reit, SGX, IBM, Bank of America, Apple, Citigroup. I took some profits from Citigroup and added more Alibaba this month.

I am so sorry for the late updates. In the past months, I embarked on this crazy trading learning journey. I’ve always been fascinated by the technicals (Candlesticks, RSI, Fibonacci, Elliot Wave, Ichimoku etc) and since I have been investing for a while. I am always curious how these tools may help me in better manage my portfolio. Thus, I gave myself a 6 months learning challenge and a seed money of $60K SGD. Thank god, I’ve managed to grow the seed money to $100K SGD todate. I am still not convinced this is a sustainable journey. Will keep you folks updated !!

Here’s a high level view of the crazy ride I had.

I am also very fascinated by Fibonacci but it doesn’t seem to work quite well with stocks.

Hi My Sweet Retirement,

Fibnonacci with Elliot Wave seemed to work quite well together. But you know, I am still a baby when it comes to technicals :). Time will tell.

The test result comes after 1,000 trades 🙂

Hi CreateWealth8888,

Haha…I am a very kiasi baby trader. Think I need more than 1000 trades to be convinced that it works or not 🙂

TA is a useful tool. We also need to consider the the macro economics (world politics- eg brexit, trump presidential election, opec oil cut) will impact the buy and selling. FA is also an important analysis. A strong fundamental company with good economic moat will rebound when market sentiment recovers. A combination of FA and TA will be a good strategy to select stocks.

Hi Zorro, well said. Thanks for sharing.

With the returns you are generating you should be running a hedge fund not a blog. :/

Hi Johnny,

Thanks for the encouragement :-). I doubt anyone would dare to buy my fund :-/.

Hi , is your trading in Singapore shares or us shares?

Record looks good so far.

Thanks for sharing

Hi, I do both. US for capital appreciation, SG mainly for dividends.

Hi! I’m inspired by your blog and is wondering how much did u started to invest when u first began in 2007? Do you follow a 20% rule? Seems hard fof beginners to start without directions!

Hi Hazel, I don’t follow a 20% rule. You can scroll through my timeline to see how much I started to invest when I first began in 2007. For some quick guide, check out this link

https://ladyyoucanbefree.com/getting-started-with-investment/

Fantastic. Looks like your portfolio is of some pretty high value shares and good solid companies. Well done. Appreciate you sharing.

I would also like to thank you for the transparency of your posts here. I am just a small time share holder which you can tell by my portfolio but I love to read posts like yours where it shows larger gains. Very inspirational.