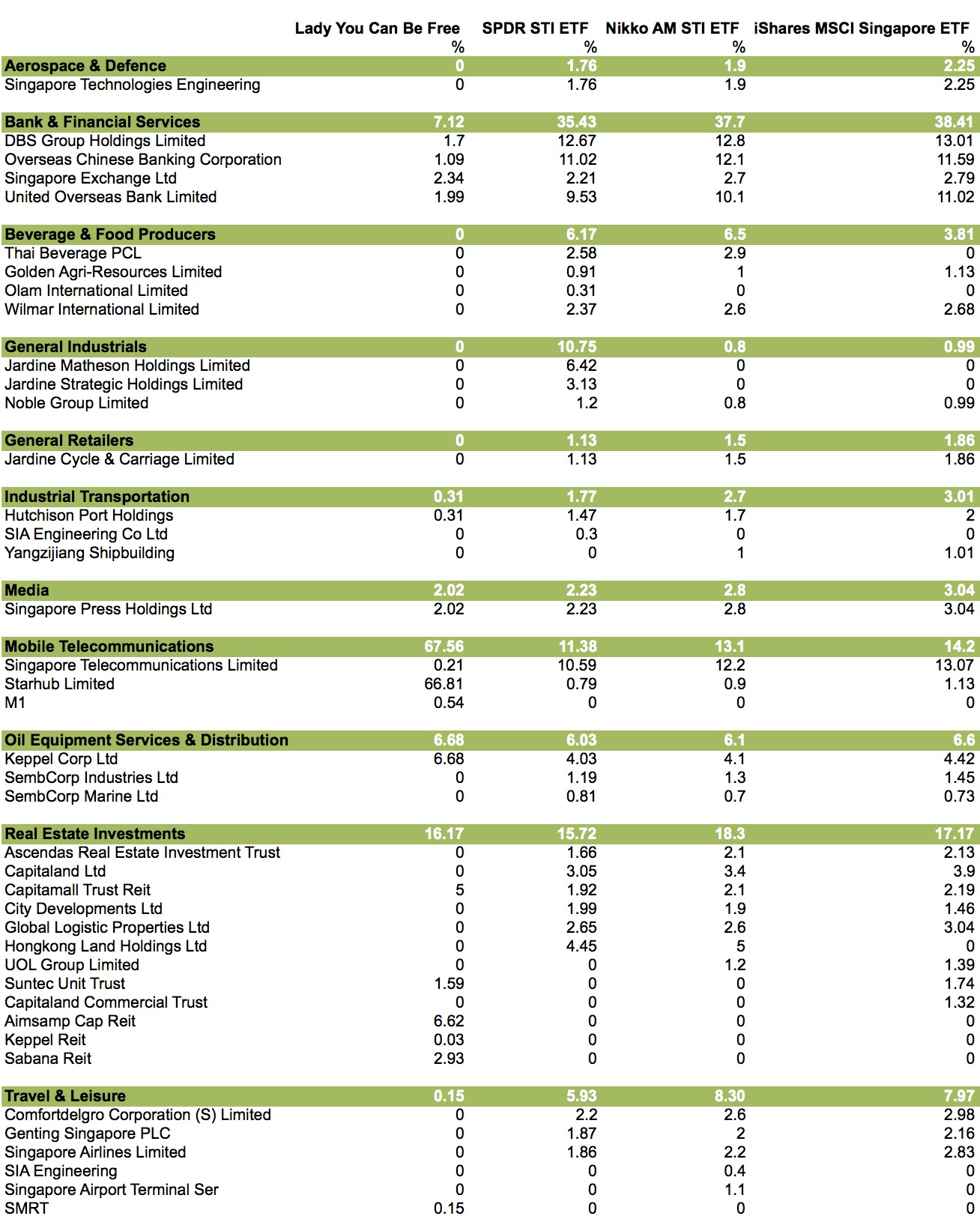

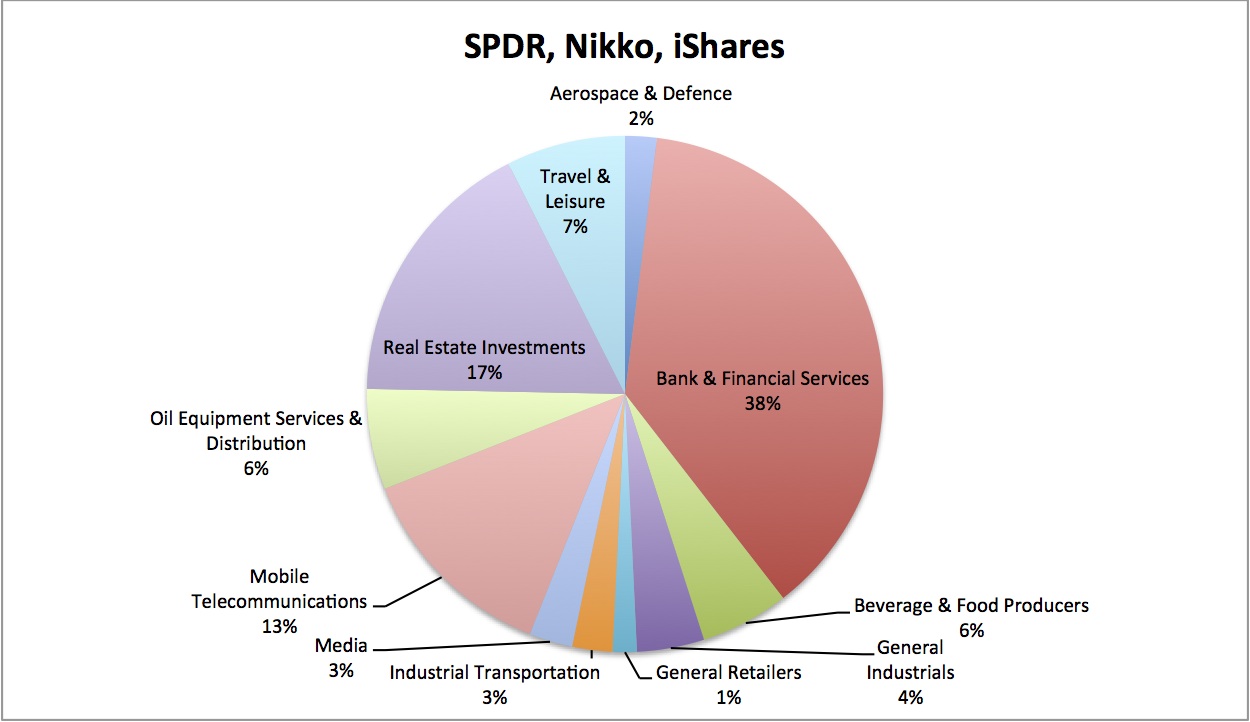

It has become a yearly habit for me to study the patterns of investment from STI ETF fund managers. Last year, all 3 funds didn’t do well, SPDR only suffered 6 months of negative returns, Nikko was negative for a year and iShares fared the worst having negative average annual return for 5 consecutive years. If you looked at the way these fund managers allocate their portfolio, you will notice that SPDR is the most focused among the lot. iShares and Nikko seemed more diversified but is all over the place when adding stocks to their portfolio. Makes me ponder whether focused is more important vs diversification.

Their top 3 sectors remained as Bank & Financial Services, Real Estate Investments and Mobile Telecommunications.

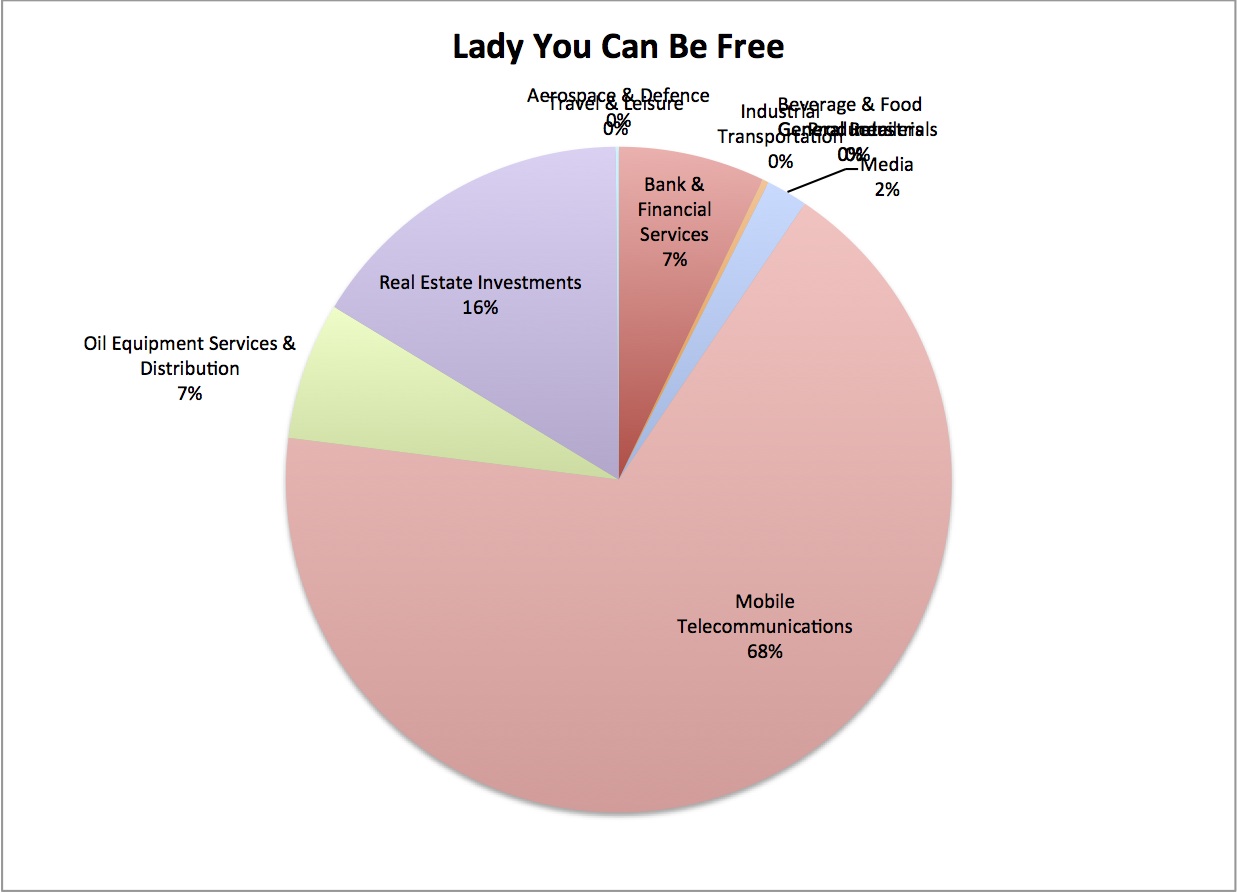

My top 3 sectors remained the same as well but my portfolio is cleaner now as compared to mine in 2014. I have since removed some weeds from the real estate investments, reduced my positions in travel & leisure and added some positions in the bank & financial services and oil equipment services & distribution sectors. I have also shifted my focus to the US market in 2015 for diversification purposes.

Did you managed to pick up some patterns for yourself ? I would loved to hear from you.

Check out my other 2014 Passive Income Playbook series :

My 2014 Passive Income Playbook - SGD 65K achievable ?.

My 2014 Passive Income Playbook - Diversification ?.

References :

SPDR Straits Times Index ETF.

Nikko AM Singapore STI ETF.

iShares MSCI Singapore ETF.

STI is heavy on banking while LYCBF is heavy on mobile comm. 🙂

Hi CreateWealth8888,

You funny ;). Banking more ex than mobile comm mah..

Your portfolio is very heavy weight on Telcos.

One stock that rules them all. You must use a lot of Starhub services yah?

Hi Lizardo,

🙂

Are you aware the funds managers of the 3 funds have no control over the funds’ allocation? They have to mirror as closely as possible to the repective indices they track, namely Straits Times Index and MSCI Singapore Index.

Hi Ray,

You seemed to know quite abit about ETF. If they have no control over the funds’ allocation and have to mirror closely as possible to respective indices they track. Shouldn’t all three have the same % allocation and same stocks in their portfolio. Why is it different ?

They are known as tracking errors. Also not sure how updated are the allocations you obtained, cause the differences between Nikko AM and SPDR seems quite significant for some counters. Their performance should be very similar also. These ETFs are known as passive ETF, ie fund managers don’t manage them actively, they just mirror the indices they track as closely as possible. Also MSCI SG index constituents are determined by MSCI group, STI constituents are determined by SPH, SGX and FTSE. The constituents are reviewed periodically. Lastly, the weightage of the constituents are by market cap, this explains why the 3 local banks and SingTel already make up close to half of the total allocation already.

Hi Ray,

Thanks for the explanation :). This is very useful information for all readers. I got the allocations from the references in my article i.e. published by them for 2015. I’ve always heard people who invest in index says that buy index and sleep over it for a decade or so and you will make money. Seems like even when you buy index, you need to analyze which one to buy in order to achieve optimal performance ? What is your thought on that?

The premise of buying say STI ETF is because one believes in the future of singapore. Corporate profits will rise due to inflation and population growth (think about your telco bills 10 years from now for example). In terms of choosing between the 2 ETFs which tracks the STI, the difference in performance is quite negligible. SPDR is slightly superior out of the 2 purely due to its lower expense ratio.

With all due respect, the basics of ETF is as per what Ray has rightly put it. The differences are due to tracking errors, which are inevitable when you try to replicate an index. No need to waste time studying the allocations of each ETF. selection rule is simply based on the lowest expense ratio and perhaps the most widely traded one for liquidity.

Hi Zng, Thanks for reaffirming Ray’s comment :-). The allocations is still insightful for me nevertheless. Cheers

The MSCI Singapore index isn’t the same as the Straits Times Index. It tracks both the large and mid-cap segments of the Singapore market, whereas by definition the STI tracks only the large-cap segment, since it tracks the top 30 companies measured (mostly) by market cap.

Hi J,

Thanks for the clarifications :). No wonder iShares has abit more mid-cap stocks.

May I know the reason that you stick you portfolio mostly to Starhub? Are you thinking of adding some banking or reits to your portfolio?

Hi Ang,

Coz I started early with Starhub and it has been serving me well so no reason to touch it at this point. I already have reits and banking in my portfolio.

There is always an argument of diversified or focused portfolio. By looking at your Singapore portfolio, I can only concluded that you will be better off with Starhub alone. The profit from Starhub have been dragged down by others in the portfolio.

I always curious on how a profitable stock investor form their portfolio in the stock market and hope that I can copy the success. Starhub has enjoyed the good time in the past, however, I am not too sure if that going to continue.Will you re-balance your portfolio?

Hi Aoptionwriter,

Not yet.