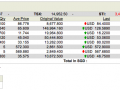

My Stock Report Card for Feb 2015

Total Dividend Collected from Jan – Feb 2015 : SGD $3,125.85

Income distribution this month came from SGX, Suntec Reit, Cache Log Trust, Capitamall Trust, Keppel Reit, Sabana Reit, Apple, Citibank. Sold Cache Log Trust.

Am staring at a paper gain of 645,260.553 SGD for my portfolio (Having butterflies in my stomach :-/). Apple is launching Apple watch today. Keeping fingers crossed 🙂

Any reason why cache was liquidated?

Any idea what you gonna do with the large pile of cash? Hehe

Hi Jimmy, my cash out of cache log is only a very small amount not 600K. I realized my post maybe a little misleading. Sorry about that. As for why I liquidated it, I feel that I didn’t get it at an attractive price that could last me thru the ups and downs. I will also be more selective in terms of the REITS that I will invest moving forward after 2 years of learning the REITS market. I am still a baby when it comes to REITS investment. 🙂

actually i have a burning question, noticed you have quite a few US stocks. But our local brokerage charged us dividend handling fee, GST, to me i find it not worth to invest in US when a cut of our dividend will be given to broker.

any advise? or alternative?

Hi Jimmy,

My strategy has been to invest in US for capital growth and SG for passive income. Thus, you may realize that most of my counters in US does not give out dividends. You are not taxed for capital gain for US stocks. You can explore some of the foreign brokerage houses that charges low commission and see whether they have some good ideas to avoid tax. I haven’t come cross ways to bypass it.

Check out..

http://www.myinvestmentforum.com/category/sgfunds-forum/cheapest-broker-for-us-stocks-monthly-passive-investments-t10392.html

http://help-your-money.blogspot.sg/2011/01/choosing-broker-for-trading-us-stocks.html

thanks

Having butterflies in your stomach?

Time to face your butterflies. Visit Sentosa’s Butterfly Park this weekend?

🙂

Hi Createwealth8888,

Thought your advise has always been to leave the butterflies alone ? Hmmm…Have I been interpreting your articles incorrectly ? 🙂

Have you been to any Butterfly Park?

Hi Createwealth8888, Yes, not the Sentosa one though.

First time holding winning stocks across market cycle of bulls and bears?

Hi Creatwealth8888,

No but haven’t gone thru enough cycles to be completely zen :).

Hi,

I noticed that in your stock report your gain is calculated based on buy price and market price.

May I check with you do you take into consideration of your transaction cost?

Or u considered it as insignificant?

and may I have your opinion for using Standchart as brokerage acc (for the reason of low transaction cost) instead of POEMS and otrs?

My overall concern is on how should I better manage my portfolio.

Thanks.

~ Newbie

Hi Tadpole,

My buy price already factors in the transaction cost. I haven’t compared across all brokerage. For me, DBS works for me as I have very little time to handle settlement thus the way they link between the brokerage and bank works for me. I’ve seen some brokerage houses that offers very good analytic tools and transaction fee. This post may help you make better decisions on which one to go for https://ladyyoucanbefree.com/getting-started-with-investment/. Hope this helps.

If a close friend or relative asking you for a loan – medical, biz start-up etc; what would you do?

Hi Money Honey,

I don’t believe in lending money to friends or relatives at all. If it is an urgent medical case, that is a different story.

hi lady, would it be possible to explain the reasons you bought each stock? how u analyse, based on what critierias, FA, TA, etc.

Hi poor boi, you may be able to find some answers here https://ladyyoucanbefree.com/getting-started-with-investment/

Woo hoo! Nearly 650k of paper gains! Huat ah! Good start to the goat year!

Hi pib,

It’s only paper gain. I hope my strategy is correct. Keep fingers crossed.

Maybe its time to quit your job, travel and do what you want! 😉

Hi pib,

Maybe… 🙂

Hi, how do you keep track of your dividend payout? Do you keep track manually or is there a special software for that?

Hi Xin,

You will get a monthly statement from CDP if you own Singapore shares and the dividend distribution will be there. If you buy overseas shares, your broker will send you a monthly statement.

Your stock card report print screen is using app? If yes what app is it?

Hi JH,

The stock report is provided by my online broker. You may want to check this link to see what broker I am using.

https://ladyyoucanbefree.com/getting-started-with-investment/

Hi, what are the reit you can recommend me to invest for long term for its yield. Is it safe to invest in keppel reit at its current share price .seek ur advice .thanks

Hi JY,

I am not an expert in REITS. You may be keen to check out this site for ideas http://singaporeanstocksinvestor.blogspot.sg.