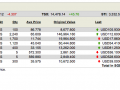

My Stock Report Card for Dec 2014

Total Dividend Collected from Jan – Dec 2014 : SGD $59,072.58.

Income distribution this month came from Aims Amp Capital Industrial Reit, SPH and Bank of America. Bought Keppel Corp. Despite revising my targets from $65K to $60K middle of this year, I still missed the target as most of my funds were diverted to the property I just bought as well as renovation :-(.

Crazy year, will share more in the coming weeks. Stay Tuned !!! 😉

Happy New Year and Merry Christmas to All !

I’m so happy for you!

Already achieved a lot more than what is possible to other people.

Enjoy your new home! 🙂

Hi pf,

Thanks for cheering me on :-). Have you bought your home yet ?

I think you already have a very impressive report card for 2014. Keep going and keep growing..

Hi Richard,

Thanks for the encouragement. In corporate terms, didn’t meet target means didn’t meet target ;-p. Hahaha.

BTW, your Penang trip looks awesome, Penang is now on my target destination thanks to your blogpost. Think you can start venturing into travel blogging ;-p.

Hi Lady,

I am sure your new place will turn out awesome.

Wishing you a Merry Christmas and a blessed New Year!

Hi Derek,

Keep fingers crossed about my new place :). Have many nightmares shortlisting and communicating with Interior Designers. Merry Christmas and a Fabulous New Year to you and your family !

Nice report card. Already way above average investors. My report card in the red this year cos trusted my “sifu” too much cos 6 figures loss. Very long never compile my portfolio liao and should be motivated like you to do it monthly. Keep it up!

Now I only can Wish all of us have good teamwork synergy and ride through 2015 market with good profits. Huat ah

Hi Freddy,

I also have one really red one staring at me ! :-/. Let’s all Huat for the new year !! 🙂

Little Red Dot. Okay lah. It won’t hurt Lady much.

Hi CreateWealth8888,

:-). U very cute. Happy New Year !

Happy New Year to Lady!

Your Little Red Dot may also teach us investing lesson that we cannot just follow our favorite blogger’s investing strategy.

Their timing of Entries has been good for them but not for us. Right?

Hi CreateWealth8888,

My lessons learnt is not so much about following. I knew when I picked it up that our favorite blogger got this at a very very cheap price. I think my bigger challenge is knowing when to let go before it sinks into a very pathetic state. I have a problem of letting things go. Maybe need to watch many times of Frozen :-). Can you share some wisdom of how you typically let things go so that me and all our readers can learn from you !!!

(1) Add a new column in the your portfolio tracking worksheet called e.g. Total Return for each stock you owned.

Total Return = Dividends received + Realized P/L + Unrealized P/L.

Now you may see smaller and smaller Little Red Dot year after year and Lady’s heart is getting warmer for de-freezing.

(2) Avoid this thinking of Average. Average just means it is getting cheaper but also getting bigger too. Think of every position as independent event. Taking profit and cutting losses may be easier to manage and overcome our emotions. Cutting losses? Size matters! Too big. Frozen heart!

(1) is easier than (2). LOL!

Hi Createwealth8888,

Good tip !! 🙂

My two lady followers were excited but later became disappointed. Guess you know why.

🙂

Hi CreateWealth8888,

Why? I am not worms in your stomach nor SMOL. Still trying to learn how to decrypt your message ! 🙂

Thakral sticks out like a sore thumb among all your investments.

I used to invest in this counter too but divested it 3 years ago due to business fundamentals.

Anyway, keep it going. You are a source of inspiration for many investors.

Regards,

SG Wealth Builder

http://www.sgwealthbuilder.com

Hi Gerald,

Happy New Year and thanks for the encouragement. You are also a source of inspiration to many readers !!

Thakral was bought by my parent using my account before I started my investment journey. Nothing much I could do about it except collect pathetic dividends from it

I would say add a column on annualized returns as well for each counter. 🙂

There is a big difference in doubling a counter return in 20 years vs 5 years

Hi Cory,

Thanks for the suggestion. Let’s see whether I can find time to add that column :).

Happy New Year !!

That’s almost $5000 a month. Some people would have retired with that. Happy Holidays!

Hi Lizardo,

Happy Holidays and Happy New Year !! :).

stumbled upon your blog, very impressive result! i definitely need some motivation and shall use your results as that! please try to keep this blog up 🙂

i will read up rest of your posts to learn as much as possible!

Cheers

Hi Terence,

I’m glad this blog served as a motivation to you. Let’s learn from one another ! Keep me posted on your learnings ;-). Happy New Year !!

Hi Lady,

I’ve been silently reading your blog. You are a true inspiration. Kudos to you and may your portfolio grow!!

Happy new year!!

Cheers,

Naro

Hi Naro,

Happy New Year ! Thanks for connecting and leaving notes of encouragement. :). U have an interesting blog yourself !!

Pingback: How a Singaporean Grew $112K to $1 Million in 7 Years | MoneyDigest.sg

Hi Lady,

Can you advise what platform for trading is good for starters?

Thanks!

Hi Tee,

I haven’t really investigated. I started with DBS Vickers and have been with them since as I am too lazy to shop around or change. You may want to check this link for comparison :

https://weinvest.net/blog/comparision-stock-brokerages-singapore/

I want to learn how to invest too. Where should I start from? How much beginning capital do you think one should before starting?

Hi E, you may want to first set a financial goal for yourself (long term and short term). Analyse your current net worth and your spending habits. Determine your investment risk profile. Start reading a couple of investment books e.g. “Rich Dad, Poor Dad”, Any books that documents different style of investment etc.. (e.g. warren buffett, andrew hallam). Check out the financial blogs available in Singapore http://thefinance.sg. Watch CNBC to get into the vibes of the market and jargons but please take a pinch of salt when they ask u to buy or sell something. Find an investment model that resonates with you most before you proceed to set up a trading account. Then set up a small sum “investment tuition” fund to learn the market. This fund should be money you are prepared to lose to learn the market. Then you are ready to start . Hope this helps.

Yes it did. Just a quick question, how much did you started with?

Hi E,

I started with around 100K. BTW, please please please don’t start trading until you are sure what you are getting yourself into.

Pingback: HOW AVERAGE S'POREAN LADY GREW S$112,000 INTO S$1 MILLION IN 7 YEARS - Asian Buzz

Pingback: How a Singaporean Grew $112K to $1 Million in 7 Years - Asian Buzz

Hi Lady,

May I know what app or program are u using for the report card portfolio you showed here?

Thanks 🙂

Hi Lisa,

DBS Vickers. It’s just the online platform that they provide for locking orders. Hope this helps 🙂

Hi Lady,

Chanced upon the post about your story on Facebook. It’s reassuring to know that recently I’ve worked towards dividend play as well despite some really bad turn of events in life leaving me in debts. It was certainly motivating and please continue to inspire and grow!

Cheers

Hi Whitelitez,

I am glad you have been motivated :-). Your note is a motivation for me to continue blogging about my journey. Let’s learn and grow together. Btw if I were you, I would prioritize getting out of debt first before venturing into dividend investing. Hope you get out of debt soon and keep me posted on your progress. Cheers

Hi. I am new here. I would like to know what program or website you use to keep track of your portfolio?

Hi Ice Kid,

I use my broker DBS Vickers website to keep track of my portfolio. I am not very impressed with their tools btw. There are much better ones out there just that I am too lazy to switch.

Hi there. You are a great inspiration to us all. Growing 112k to 1million in 7 years requires a compounded annual growth rate of 36.7% each year (even through the GFC). I was hoping you could share how did you manage to do this through your approach of investing in dividend stocks which typically yield 3-7% a year.

Thank you!

Hi C,

Thanks. I am glad you have been inspired. I have documented my investment journey in my blog through the format of a timeline. You may be keen to check it out. Alternatively, check out these 3 links that may be give you greater insights.

https://ladyyoucanbefree.com/getting-started-with-investment/

https://ladyyoucanbefree.com/2014/01/04/2014-stock-playbook/

https://ladyyoucanbefree.com/2014/01/18/2014-passive-income-playbook-diversification/

Hi, I’m just getting started on investing and I must say you are one fine inspiration to myself!

Hi SSS,

I am glad you have been inspired. Good luck and keep me updated on your learnings and progress 🙂

hello may i know what other tools you recommend to track our portfolio?

Hi dex,

I have written a mini-guide. Check it out at https://ladyyoucanbefree.com/getting-started-with-investment/

hi, came across your blog, I’m a Singaporean student, studying econs and finance, my parents give me a monthly allowance of $1,000I’m also very interested in stocks but I have not much knowledge on where to start. How much should I set aside for investment in stocks and how should I go about? Thanks 🙂

Hi Kaustubh,

Wow you have so much monthly allowance. ENVY !!!

Here’s a high level guide :

You may want to first set a financial goal for yourself (long term and short term). Analyse your current net worth and your spending habits. Determine your investment risk profile. Start reading a couple of investment books e.g. “Rich Dad, Poor Dad”, Any books that documents different style of investment etc.. (e.g. warren buffett, andrew hallam). Check out the financial blogs available in Singapore http://thefinance.sg. Watch CNBC to get into the vibes of the market and jargons but please take a pinch of salt when they ask u to buy or sell something. Find an investment model that resonates with you most before you proceed to set up a trading account. Then set up a small sum “investment tuition” fund to learn the market. This fund should be money you are prepared to lose to learn the market. Then you are ready to start . To start a trading account, you need to choose a broker and check out this site who has done a comparison https://weinvest.net/blog/comparision-stock-brokerages-singapore/. But please please please don’t start trading until you are sure what you are getting yourself into. Hope this helps.