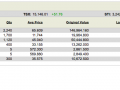

My Stock Report Card for June 2014

Total Dividend Collected from Jan – June 2014 : SGD $30,355.22

Sold Wing Tai, Capitaland and Banyan Tree to raise some cash to cover my property payment. Income distribution this month came from Apple, Citibank, UOB, OCBC, Aimsampi Reit and DBS. My US portfolio is looking really promising. Am looking forward to the financial results of Apple in July and her upcoming product launches. I hope the fruit will not disappoint.

Hi,

Really envy your positive portfolio, especially your Starhub counter. How long you take to build up such a impressive result ? Your large available fund is one thing but how you do it differently (Not sure whether you can share on this)?

I have built up my 150K portfolio in local stocks but it has negative P/L around 15-20%. Quite disappointed.

Hi Ryan,

I started in 2005. I think what I did right was that I invest in stocks that I can understand thus even when the market was really depressed during 2008, I didn’t waver but took the chance to pick up more attractive stocks which I believed they have potential and good track record. Hope this helps.

Hi Lady,

great work here. Looking good.

You stock summary looks good and clear.

Out of curiosity, which stock trading plateform are you using ?

Do you use/pay for other financial trading and analysis services ?

I am on a invetsment journey too. Your toolbox is surely effective, would you share with us on the tools you use daily ?

Best,

Cha

Hi Mr Cha,

Thanks. The stock trading platform I am using is DBS Vickers. It is the only tool I use and it’s free. To be honest, I don’t really like the tool, think it could do better :). For Singapore Market, I only use the SGX website occasionally to check up the history of some new stocks that I am thinking of entering. For US Market, I use the CNBC website occasionally for news. Most of the time, I prefer watching the CNBC channel. I have not bought any financial trading and analysis services so far. Hope this helps.

All the best in your investment journey, keep me posted on the results !! 🙂

Wow! A very impressive report card, indeed! Congratulations!

Hi Richard,

Thanks 🙂

Hi just curious, may i know why you bought so many Starhub shares? Your Starhub share price gonna reach $1mil quite soon!

Hi Lady,

I accumulated starhub then because they were increasing dividend YOY in the good old days and they actually commit to the dividends that they will pay for the next year in their annual results. They have been consistent with their promise. So I liked them then. Now, I am more cautious about their future.

Hi,

I see you have a large portfolio of REITs and other high-yield dividend stocks. Did you face any challenges when there are rights issues, especially by the REITs?

What were your reactions like during the global financial crisis in 2007-09?

Did it significantly affect your dividend yield?

Hi Lizardo,

I only started REITS after the crisis, so not much experience to share in this space.

Not much issue with Rights Issues either, you either take the offer or reject them. I usually decide based on how attractive the price of the rights issue were.

As for my reactions during crisis, I was quite comfortable with my portfolio during the financial crisis, although my portfolio halved, it didn’t impact much of my dividend yield. In fact, I was happily grabbing discounted stocks which I have been eyeing for awhile.

Thanks for sharing.

Would seem that if a Rights Issue is rejected, it would probably mean dilution.

Glad to know you had a positive experience during GFC by maximising your dividends. I noticed that for US dividend champions, their dividends tended to continue to maintain or grow. But for SGX stocks, that may not necessarily be the case, except for a very few exceptions. SGX stocks tend to target a certain percentage payout rather than to maintain and increase dividends year on year.

Hi Lizardo,

You are spot on that US dividend champions typically have a history of increasing yield YOY. Very rare that Singapore shares does that. Starhub used to be one when I first bought them but I think they’ve since met their threshold. :-/

A few possibly good ones locally worth tracking. Perhaps: Boustead, VICOM and HourGlass?

Hi Lizardo,

Thanks for the tip. Will check it out !

Thanks for sharing. I started off about 3 years back (after the 2008 market crisis). Hope I’m well prepare to the next phase of depress market and able to pick up some good counters and achieve good positive returns. Cheers!

Hi Ryan,

Me too :-). Keep fingers crossed.

You are a millionaire sugar mommy!

Regards,

SG Wealth Builder

http://www.sgwealthbuilder.com

Hi Gerald,

You are too funny !!!