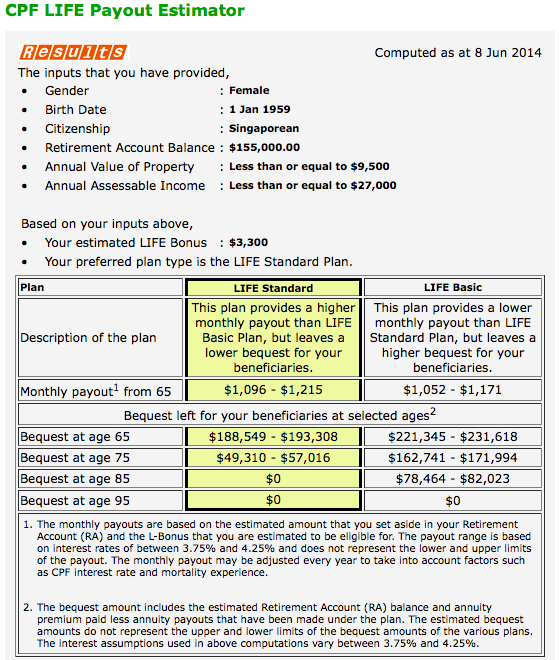

I stumbled across Investment Moats website last week about CPF Life. Curious, I went to the CPF life calculator website to check out what it really means to a 55 year old retiree with a minimum sum of SGD 155,000 in his/her retirement account. I was surprised that with just SGD 155,000, you will be entitled to get SGD 1,096 to SGD 1,215 per month from 65 years old onwards until you die !!! Wow, this is great !

Why is this great ? Assuming you were able to withdraw this full SGD 155,000 at 55 years old. At SGD 1K per month, this sum of money can only last you 13 years if you don’t invest the money (i.e. 68 years old). With CPF life, SGD 155,000 guarantees you a payout of SGD 1K per month until you die (According to world bank, the average life expectancy of a Singaporean is 81.89 years old in 2011) ! Isn’t that awesome !

Imagine an aging couple, both having fulfilled the minimum sum of SGD 155,000 and their HDB fully paid up. They would have a combined income of SGD 2K. Quite a decent income to retire simply. At least you do not need to resort to selling tissue papers on the street just to put bread on the table. This scheme really takes the pressure and load off the kids of aging parents. By contributing an additional allowance of a couple of hundreds or a thousand to their aging parents, their parents would be able to live a very decent and happy retirement life, even taking short trips here and there. I wished I had found this out earlier, then instead of giving allowances to my parents, I should have allocated some of these allowances as top up to their CPF account ! Not sure whether it’s too late to start now.

What about you ? Does your wife, husband and parent’s CPF fulfills the minimum sum of SGD 155,000 ? If not, encourage them to find means to top it up by getting out in the workforce. The best gift a parent could give to your kids is to ensure that you have a well planned retirement.

Source : CPF

Source : CPF

Check out My Retirement Planning Series :

My Retirement Planning Project 2014 - My Bucket List.

My Retirement Planning Project 2014 - Hurray, My Retirement Home ?!.

My Retirement Planning Project 2013 - Property ?.

My Retirement Planning Project 2013 - SGD 51K per year passive income ?.

My Retirement Planning Project 2013 - Retire by 42 ?.

Women live longer than 82. Lagi shiok for you. LOL

Hi Createwealth888,

Hahaha, you are so cute 🙂

What are your thoughts on the recent out cry on cpf? Seems like a lot of pple feel it is a caff idea but wondering what a financial prudent person like you would think? I am all for cpf actually but a lot of friends my age about early 30s are not.

Hi gagmewithaspoon,

My thoughts about the recent outcry on CPF? I guess more education and communication is needed on the benefits of CPF.

Nice article and I am all for the CPF scheme and its CPF Life product.

Even though some smart investors might be able to generate more returns than CPF Life but it is not without risks, so, I am happy for CPF Board to take over the burden of the risk and give us the risk-free returns (which is better than the interest rates in the banks).

Hi Richard,

I hope we are not the minority. I guess it’s a wakeup call for us to start pondering whether it’s time we start introducing financial education in schools so that fresh graduates understand why CPF, CPF life and even MediShield life is going to improve their families well-being and let them understand why it’s not that easy to generate a 6.5% returns without risk.

There are financial education in schools nowadays provided by 3rd party service providers.

It is called Life skills and includes financial literacy, entrepreneurship, social enterprises etc.

It is very much the attitude of the students and also the emphasis of the parents that determines if the students are to really benefit from these courses.

Most are still living in the dinosaur age (parents and students) where too much emphasis is on academic excellence, which only gives a headstart, but not permanent income or salary.

It is lifelong skills such as financial literacy, entrepreneurship and business acumen, which can give these students fishes for life as these can provide a means to generate income for life.

Hi Numbers,

So true !!!! Academic excellence for a better career is so passé.

Hi LUCBF

I think the issue here would be the whether the minimum sum would be raised again ? While i think it is a good “retirement ” scheme to have , more transparency is needed too .

Hi Small-Time Investor,

Thanks for sharing the insight. If it’s all about minimum sum and transparency, I wonder why the campaign is about returning the cpf. It is extremely misleading to the general public. Minimum sum would definitely need to be raised again as time moves forward to keep pace with standards of living. What we need to do is to learn how to leverage on this CPF tool to ensure we grow and keep pace with the minimum sum. Also, I am not sure about transparency. If people cannot even understand why 6.5% is not a reasonable demand in terms of returns without risk and the benefits of CPF Life, then I think they would probably faint when they see the transparent statements presented to them.

Hi LUCBF

There would be a sway of topics when emotions sway .

That’s where people have to calm themselves down and think rationally.

Hi Small-Time Investor,

True. I pray that many more people will be calm & rational.

hi there, i think thanks for mentioning my article i hope its been helpful. just want to bring your attention to a perhaps misconception. i wrote in a later post

that the way you look at it is for 155k at age 55 to grow to around 240k at age 65. the 240k provides the 13k per year. its not about withdrawing 155k at 55 years old comparison but could you do better with 240k.

Hi Kyith,

Thanks for highlighting. For me, I don’t really care whether I could do better with the 155K SGD from 55 to 65 years old. What I liked about the model is the peace of mind I get by putting 155K away knowing that at the bare minimum, I would have at least a guaranteed 1K SGD per month from 65 until I die. During this period, I may have gone senile or have dementia, incapable of making sound investment decisions on my money.

However, this is good info for others who may think other wise. Check out Kyith’s article from here…

http://www.investmentmoats.com/budgeting/retirement-planning/i-thought-cpf-life-annuity-gave-a-high-8-5-return-perhaps-i-am-wrong/

Hi Lady I have some questions for you:

1. Did you invest using your CPF money?

2. Do you have fellow girlfriends who invest also? and are they supportive about your investment choices?

I would like to invest soon but none of my female friends are interested to invest 🙁

Hi YoungLadyWhoWillInvestSoon,

Good to hear from you. Answers to your question

1) I used to invest my CPF money. But I have sold them recently to pay for the HDB that I recently acquired.

2) I do have fellow girlfriends who invest but they are not avid investors. Most of my girlfriends are believers of property, FD, unit trust and they get burnt quite often in stocks. Not sure why. I typically don’t ask them for advise when it comes to investment choices. They usually will tell me that the market is going to crash and that I would lose alot of money ;-). I find it more useful discussing with guys around this topic.

BTW…if you are new to investing, don’t start with CPF first unless you are confident you can get better returns than what CPF is giving you. Start with your idle money first and start small. You will probably make a couple of mistakes and soon get a hang of it depending on your risk appetite. Have fun 🙂

Newbies have not earn their right to invest CPF money.

2.5% compounding interest is not easy to beat.

Hi CreateWealth8888,

Very sound advise ! Thank you !

Read? Your CPF Investment Account : Uncle8888’s foolish advice!!!

People who cry over the need to manage the CPF money themselves do not deserve it.

Why. If they are so good, why do they need to tap on CPF fund ?

People who cannot beat CPF protection and returns, clearly is best left with CPF to support their retirements. I am not going to pay more taxes to help them !

Well Said, Cory 🙂

Thank you for answering me and giving advise. May you have good health and a happy retirement soon. 🙂

Hi YoungLadyWhoWillInvestSoon,

No worries. :). Keep me posted on your progress !!

Pingback: Daily SG: 13 Jun 2014 | The Singapore Daily

Hi The Singapore Daily,

Thanks for sharing my article. 🙂

Hi, the flaw, which many don’t realize is…the payment amount will fluctuate. Giving us $10 per month is also giving us income for life. If you read the fine print, you’ll see the $1,000 is only an illustration, not a minimum nor guarantee. Don’t count on getting $1000 for as long as you live under CPF Life!

Hi Anonymous,

Thanks for highlighting the fine print ! 🙂

I would like to state that I do not have issue with leaving minimum sum in my RA so that I can draw a monthly payout starting from 65. However, when CPF LIFE was first announced, it was claimed as an improvement upon the previous Minimum Sum Scheme where payouts is for about 20 years whereas CPF LIFE will give you a monthly payout starting from your drawdown age, for life.

The issue I have is with the CPF LIFE plans, particularly on how the bequest is computed. CPF Board has to be more transparent on how the bequest is computed. I also believe I would be able to enjoy a higher monthly payout with the Minimum Sum Scheme, even stretching the payout from 20 to 25 years (reaching age 90) because no money from my RA is used to buy annuity and will continue to earn interest for my RA.

I leave you and your readers to compare the bequests between CPF LIFE Standard plan with the Minimum Sum Scheme with a monthly payout of $1200. The amount in the RA will be depleted at age 93.75.

Minimum Sum Scheme

Age Total Monthly Payout Bequest

65 $0 $236,642

70 $72,000 $211,229

75 $144,000 $181,667

80 $216,000 $145,571

85 $288,000 $101,497

90 $360,000 $47,623

93 $403,200 $8,809

Hi Larry,

Thanks for highlighting. Could you provide more illustration. I don’t quite understand your concern with regards to the Bequest. I would love to get this insight from you. I created a spreadsheet that computes the incremental 4% interest and the yearly 1.2k per month draw out rate. The funds would have depleted at 89 years old. Thus, the bequest seemed reasonable to me if I look at the table. Correct me if I am wrong !!!

https://ladyyoucanbefree.com/cpf-life-payout-calculation/

Hi Lady,

Did you factor in the additional 1% interest the first $60K in the RA will earn? The interest from the first $60K will drop only when the amount if RA falls below $60K, which will happen when nearer to last 5 years of payout.

From my computation, the sum in RA will be depleted at 93 years and 8 months, which I think is an age that can be considered as FOR LIFE. But when I compare the bequest between CPF LIFE Standard plan and the and the Minimum Sum Scheme, the difference is too much. I will redo the above table:

Bequest from CPF LIFE Standard plan (upper end of range given) vs Minimum Sum Scheme (amount left in RA):

At age 65: $192,554 vs $236,642

At age 75: $45,470 vs $181,667

At age 85: $0 vs $101,497

At age 90: $0 vs $47,623

I took up the CPF LIFE Basic plan last year because it will give higher bequest, but it is still lower than the MSS and also pay a lower monthly payout. Using the $1200 for Standard plan with minimum sum of $155,000 as a guide, I believe the monthly payout for Basic plan will be at most $1100.

Under the Basic plan, the two amounts of about 10% deducted from the RA at age 55 and 65 to buy the annuities will total up to about $36K. These amounts will grow to a total of about $120k at age 90 if left in the RA. For LADY, the amount deducted will be even higher, about 13%.

My guess is that the amount left in RA is used to compute the monthly payout that will start paying from age 65 until the RA is depleted at age 90. ONLY THEN the annuities will kick in to pay the same monthly payout for life.

I believe not many are aware that the annuities only kick to pay the monthly payout at age 90. This knowledge is important because IF that money had been left in the RA, it would have grown to $120K and this $120K can carry on paying the monthly payout of $1,100 for another 11.5 years, i.e. till age 101.5, before being depleted. Then the MSS is not only also paying monthly payout for LIFE, but also with higher bequest too.

Bequest from CPF LIFE Basic plan (upper end of range) vs Minimum Sum Scheme (amount left in RA):

At age 65: $233,553 vs $236,642

At age 75: $171,391 vs $181,667

At age 85: $77592 vs $101,497

At age 90: Not stated vs $47,623

Unless I have any wrong assumption or computation, I am disappointed with the claim that the CPF LIFE is a great scheme, compared to the MSS, because it pay your for LIFE, and the discontinuation of the MSS.

Hi Larry,

Thanks for the insightful and detailed comparison. Wow !! You are willing to get a lower payout to enjoy a higher bequest for your family ! So sweet of you :-). I am so selfish. kekeke. Any insights into why the government has decided to introduce LIFE and discontinue MSS? I suspect they are trying to ensure that everyone (esp. the disadvantaged) will get at least something when the MSS runs out? With the growing aging population, it would be a disaster if our streets are suddenly flooded with these elderly whose MSS has ran out and we need to introduce another system to take care of them ? What do you think?

It is not about MSS running out but how much CPF members will have in their RA when they reach 55. The draw down years can be increased from 20 to 25, 30, or even 35 if necessary. It will still be better than the CPF LIFE plans.

However, if the CPF aims is really to build up the annuity pool to assist the disadvantage, then the board should be more open about it and the rationale of which scheme is better becomes irrelevant. I will be happy and more than willing to do my part and contribute to the pool.

Hi Larry,

Agree. More communication and education is needed towards this new CPF scheme. I guess we have moved on to a new phase where we want to understand and appreciate why certain policies are made instead of just blindly accepting whatever policies that is being passed down. You know, as a single with two aging parents. I am constantly struggling in terms of the retirement and medical amount needed to cover 3 person. With CPF Life and Medisave Life, it actually helps singles like me set a better baseline when I am planning for three. At the bare minimum, I should target that all 3 of us should meet the minimum sum. This is to me a great safety net to fall back to should all else fail.

Is certainly an important safety net. There will always be people who are tempted or with reason to want to tap on CPF before retirement. We shouldn’t. If you need it now, you will need more later. And there’s nothing to fall back on when you really retired.

Hi Cory,

Looks like we share the same kiasu, kiasi mentality :).

hey LYCBF,

chanced upon your blog only very recently, and been catching up on your old blog posts. wanna drop you a note to thank you for the sharing~

also, i’m with you too, on how CPF life is gonna help retirement. i too think some people have lost the plot in the protest frenzy. agree that communication and education are key, and not just from CPF, even bloggers such as yourself can share too, since there are lotsa people who would rather read blogs than CPF website or news ^^

have a good week!

Hi BB,

Thanks for the kind note. Gives me energy to continue blogging :-).

Pingback: Gregory Smith

Thanks Gregory :-).

Pingback: Breadwinner Series : Are your aging parents ready for retirement ? | Lady, You Can Be Free