When I kickstarted my retirement planning project this year, I asked myself two question. When should I retire and how much do I need to retire.

80 is the new 60 when it comes to retirement ?

The Singapore paper highlighted that more are living beyond 100 years old and that the average livespan of a lady has increased to 84.5 years old !!! I remembered receiving quite a number of sms from friends that day exclaiming that they really don’t want to live THAT long. How ironic, our ancestors spend all their life seeking longevity while our generation prays hard that they don’t live that long.

Another disturbing trend observed in US is that 80 seemed to be the new 60 when it comes to retirement since the 2008 financial crisis.

http://nypost.com/2013/11/16/80-is-the-new-60-when-it-comes-to-retirement/

How much do I spend yearly ?

I always thought that I spend approximately SGD 3K per month. SGD 1.5K for parents allowance and another SGD 1.5K for my expenses. Thus, having a decent SGD 5K per month should be a sufficient retirement income for me. This would leave me with approximately SGD 2K per month for emergency and investments. Having already achieved SGD 41K per year in passive income leaves me into thinking that I should be able to achieve SGD 60K easily by the age of 40 or maximum 42. Thus, I could safely retire by 42?

How much do I REALLY spend yearly ?

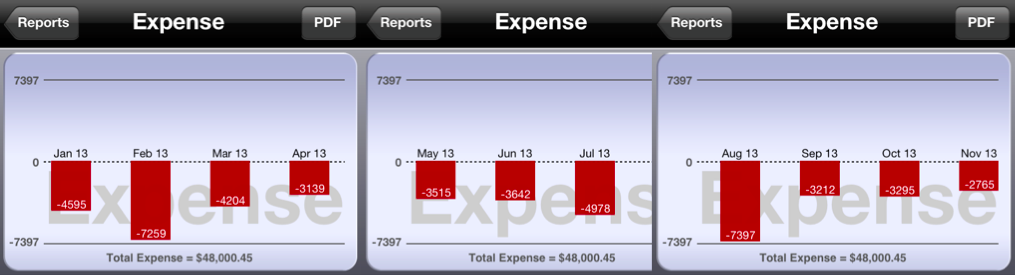

Since my target retirement age 42 is just 3 years away, I thought I better make sure that I REALLY only spend approximately SGD 3K per month. I downloaded iXpenseIt from the iTunes Appstore and started keeping track of my daily expenses. I told myself to spend freely like what I have always been doing as I wanted to know how much I really need to live freely even during retirement.

To my horror, my spending every month far exceeded what I thought I really spent.

Need vs Want

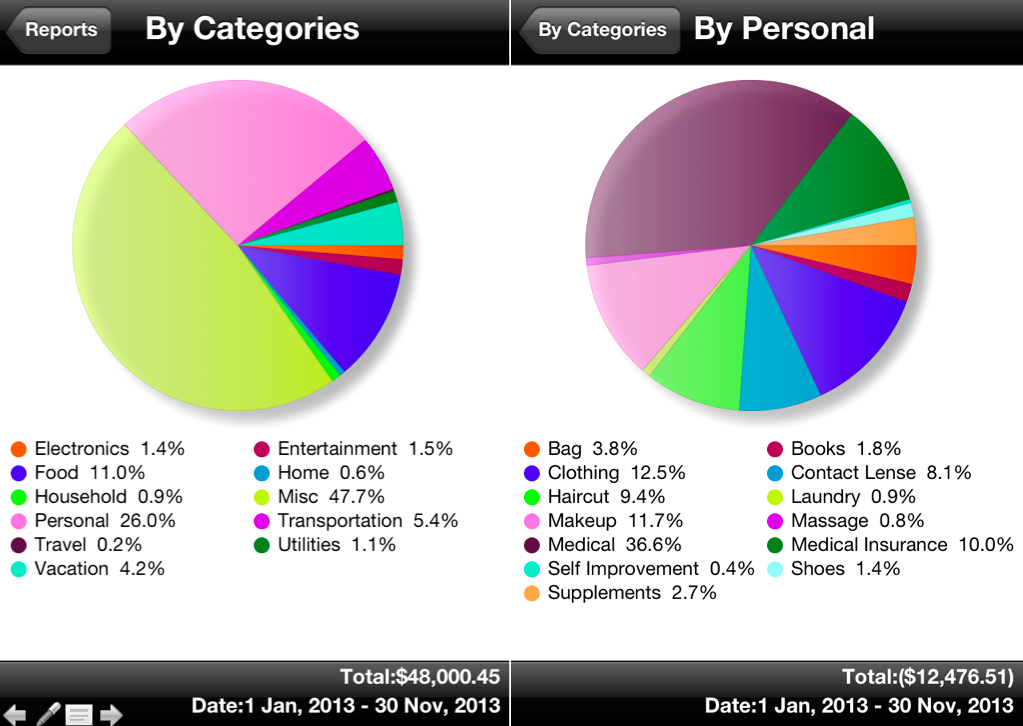

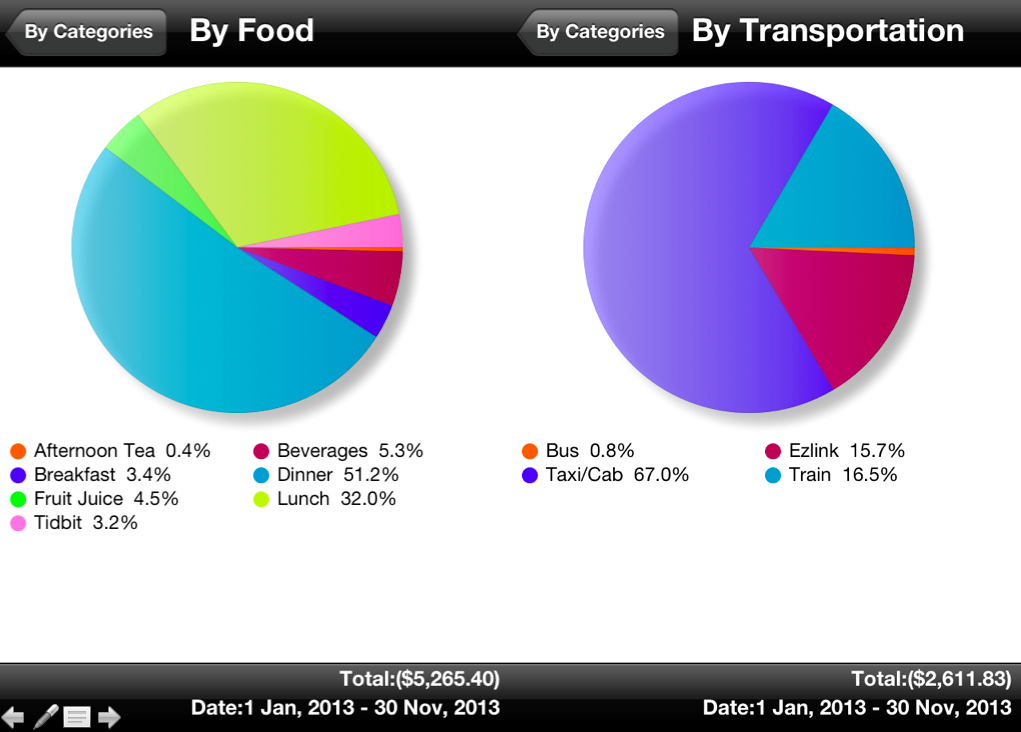

Another interesting discovery is that a lot my expenditures are WANTS not NEEDS. Thus, if I can reduce my WANTS, I may not really NEED that much to retire. The largest percentage of my expenditure (i.e. Misc) goes to Parents Allowances and Taxes, followed by Personal, Food and Transportation. Even when I eat out every day for every meal, I only need approx. SGD 6K per year ! As for transportation, if I could just cut down on the number of taxis/cab I take. I probably only need SGD 1K per year ! Finally, I REALLY need to find a new hairdresser !

How much do I REALLY need to retire ?

With such discovery, I have decided that I may need at least SGD 10K per month before I feel really safe to retire. Considering I have only managed to grow my passive income by approximately SGD 10K per year. I would probably need to work at least 8 more years before I could retire. Sigh, that means 47 years old ….

Download iXpenseit and gain insights into your spending :

My Retirement Planning Project 2013 Series

My Retirement Planning Project 2013 - SGD 51K per year passive income ?.

My Retirement Planning Project 2013 - Property ?.

Counting beans on a daily basis is not the way to go!

Check out my latest article, “Budgeting”, in my blog, SG Wealth Builder!

Regards,

http://www.sgwealthbuilder.com

Without counting the beans. How would you know the number of beans you really need ? ! 😉

Thanks for sharing.

No kids?

Good advantage

Yupz. No Kids. I paid for my sibling’s college & university education so I guess I know what it takes?

Hello I chanced upon your blog and I would like to say I’m thoroughly impressed by your discipline to keep to your goals. Keep it up!

Thanks for the kind words. I will definitely try to keep it up…

Way way impressed that when most are dating or looking at the next car to buy, you already planned & walking towards that goal. Wished I had such street smartness when i was 35.

Perhaps, today my intro will be “42, semi-retired & driving around exploring SG, MY & TH (or Asia for that matter), loves to take photos along the way”

Looking forward to your next update soon. 3 cheers

Haha…I said the same thing to some of the Gen Y financial bloggers 🙂

Congrats on your plan. I too am planning to retire in my 40s. Here’s a few thing to consider:

1) Your portfolio is too concentrated. You have way too many financial and REIT stocks, and one stock consisted 70%+ of your total portfolio. Your need to diversify your portfolio.

2) Why isn’t CPF in your calculation ? Even though it can not be drawn for early retirement, it is still part of your nest eggs.

3) Once retired, it is pretty hard to get back into the work force so you should have excess cushion and not just living on or near the baseline. Also remember that medical expenses tend to go up when you are older.

4) Plan for a worst case scenario. Your portfolio need to withstand a significant market downturn. You should figure out what could happen if the market fall for a few years to see if your passive income will still be the same.

5) Your focus should not be on passive income but rather, total income. The market is so focused on dividends that most dividend paying stocks are over-valued.

6) You paid, at least in part, for your sibling’s educations. Time for them to step up in terms of helping your parents, this should free up some of your cash flow.

Thanks Ting Lee for the very valid & kind advise ! Good to connect with ladies who are interested in financial planning besides shopping & more shopping :).

Hi Lady,

I am sure you will reach your goals. ^^

By the way, I added ST Engineering to my portfolio today.

Hi Dividend Warrior,

Wow, you really kept your promise ! Thanks ! 🙂

Since your high paid, I think SRS is good for you. Even you withdraw with 5% penalty, still much lesser than your tax rate.

Hi Ah John,

Thanks for the advice. Will take a look at SRS to check out the savings on the tax.

I LIKE your banner!

Hi Ah John,

Thanks :).

Pingback: How a Singaporean Grew $112K to $1 Million in 7 Years | MoneyDigest.sg

Pingback: Breadwinner Series : Are your aging parents ready for retirement ? | Lady, You Can Be Free