My Stock Report Card for Jan – Feb 2018

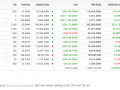

US Stock

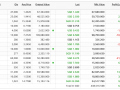

SG Stock

Total Dividend Collected between Jan – Feb 2018 : SGD $ 2,650.71.

Income distribution in Jan and Feb came from Aimsamp Cap Reit, Nikko Asia Reit ETF, Singtel, Sabana Reits, Keppel Reits, Capitalmall Trust, SGX and Suntec Reit.

Total Profit/Loss from Sales of Stock between Jan – Feb 2018: SGD 0.

Gong Xi Fa Cai ! Happy New Year ! Don’t forget the 12 Million Toto draw tomorrow.

I added some Tencent, MapleTree Logistics, MapleTree Industrial and ST Engineering during the market dip this month. February has been a roller coaster ride for the US stock market, the Volatility Index surged to almost 30 and the stock market plunge almost 1000 points giving back 50% of all the gains in 2017. While I was shopping for bargains, the market went up again recovering what it has lost before I could take any concrete actions. Looks like we are now trading in an environment where the robots have a certain set of stop loss rules thus triggering this panic sell despite a relatively healthy and vibrant economy. Did you managed to get some bargains during the flash sale ? If yes, congratulations !

Songs that are in my playlist these months : (Yeap, I caught a Hyukoh virus :-p)